Bitcoin Price Prediction: $200k Next? Unbelievable!

Bitcoin (BTC) up 0.52% over the past week, with a market cap of $2.09 trillion and a 24-hour trading volume of $68.04 billion. This renewed optimism is fueled by record-breaking inflows into spot Bitcoin ETFs, growing institutional interest, and strong political support—including Donald Trump’s proposal for a Strategic Bitcoin Reserve.

With major players like GameStop and Trump Media adding Bitcoin to their balance sheets, and the Federal Reserve hinting at possible rate cuts, investors are now asking one critical question: How high can Bitcoin go next? Check Out Bitcoin Price Prediction 2040 !

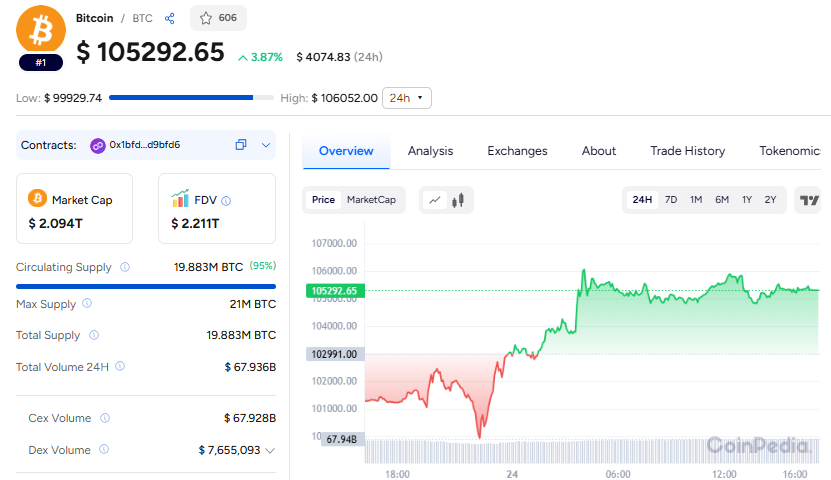

Bitcoin (BTC) Price Overview

According to Coinpedia, Bitcoin (BTC) is currently trading at $105,292.65. It hit an all-time high (ATH) of $111,814.00 on May 23, 2025, and an all-time low (ATL) of just $67.81 on July 6, 2013.

While BTC is down 5.83% from its recent ATH, the staggering 155,175.99% gain since its ATL highlights the long-term, explosive growth of the asset, making the current dip look like a brief pause in a powerful uptrend.

Institutional Giants Double Down on Bitcoin Dips

Institutional confidence in Bitcoin is surging, with over 240 publicly traded companies now collectively owning 3.96% of the total BTC supply (over 832,000 BTC).

Despite recent market pullbacks, major players like Metaplanet and MicroStrategy are aggressively accumulating, signaling a strong belief that Bitcoin remains undervalued. With converging macroeconomic pressures, geopolitical uncertainties, and escalating institutional interest, Bitcoin appears primed for its next surge, potentially reaching new all-time highs in the coming months.

Bitcoin's Path Forward: Will BTC Go High?

The outlook for Bitcoin remains firmly bullish, driven by powerful underlying fundamentals. We're seeing unprecedented institutional adoption, with a significant portion of Bitcoin's total supply now held by publicly traded companies. This, coupled with the inherent scarcity post-halving and Bitcoin's strengthening position as a global store of value, sets a strong foundation.

If the current momentum persists—fueled by sustained ETF inflows and broader mainstream integration—Bitcoin is well-positioned for a significant rebound. Analysts are increasingly optimistic, projecting that Bitcoin could potentially reach $200,000 by year-end.

Customer support service by UserEcho