Top 3 Reasons Why Near Protocol Crypto Price is Set to Soar

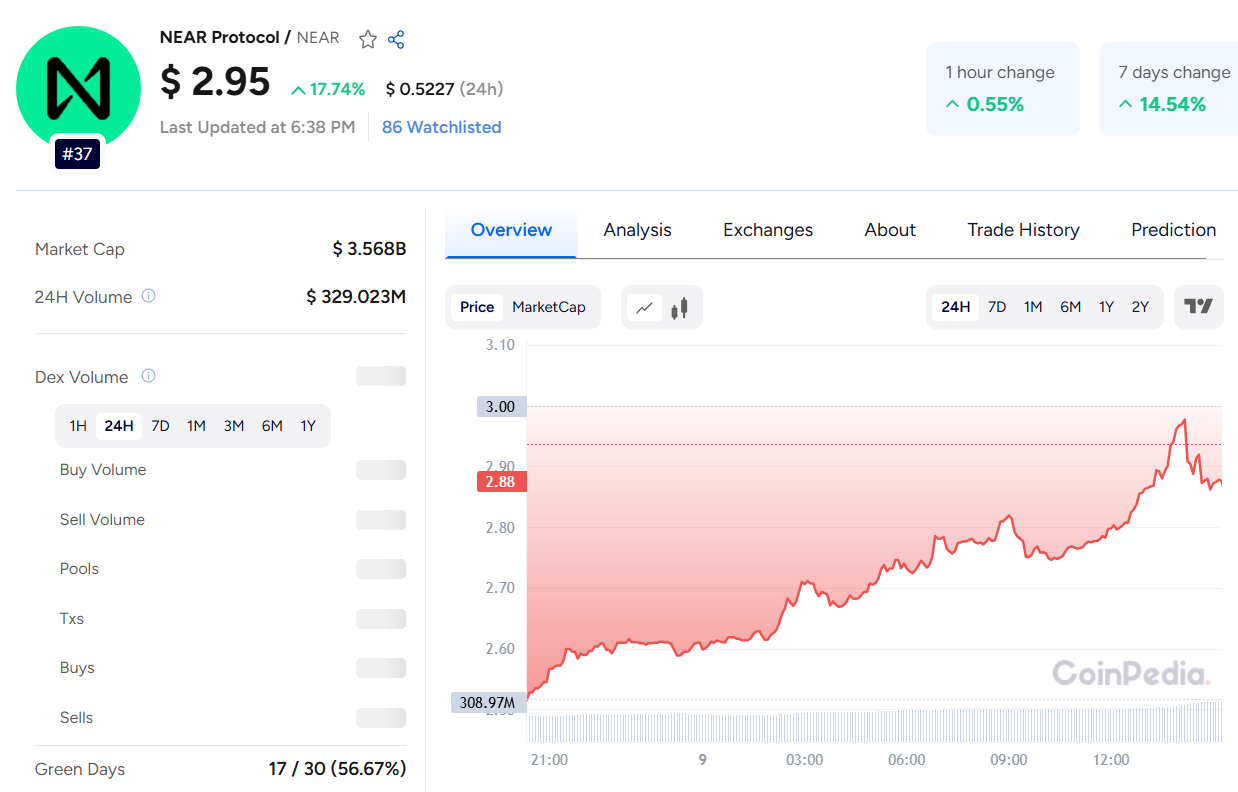

NEAR Protocol is showing renewed strength in the market, trading live at $2.95, with a 24-hour volume of $329 million. The token has seen a 17.74% gain over the past 24 hours and continues to inch up, gaining 0.55% in the last hour alone. With a circulating supply of 1.21 billion NEAR, momentum seems to be building steadily, sparking increased interest in the NEAR Protocol price prediction among traders and long-term investors.

One of the primary catalysts for this bullish move is the rise in staking activity. According to StakingRewards, the last 30 days saw an inflow of 44 million NEAR tokens, valued at approximately $114 million. This surge lifted the staking market cap to $1.56 billion, pushing the staking ratio to 47.9%. Increased staking typically indicates reduced short-term sell pressure, as holders lock up their tokens in pursuit of passive income.

On the technical front, NEAR has displayed strong reversal signals. The daily chart shows a clear inverse head and shoulders pattern, and price has broken above the 50-day moving average. The Percentage Price Oscillator (PPO) has also crossed the zero line, turning upward. With the current trend, bulls are eyeing a move toward $3.50, a key resistance and the 23.6% Fibonacci retracement level from November.

Beyond price action, NEAR's on-chain activity is booming. In the past seven days alone, the protocol processed over 40 million transactions, making it the fourth most active blockchain, behind only Solana, Tron, and Base. In the past month, NEAR processed 186 million transactions, surpassing even Ethereum. The total stablecoin value on NEAR has also climbed to $715 million, reflecting growing user confidence.

In summary, NEAR’s price surge is backed by strong fundamentals: rising staking inflows, positive technicals, and booming network activity.

Servicio de atención al cliente por UserEcho