Stellar Price Surge Faces Resistance: XLM Outlook

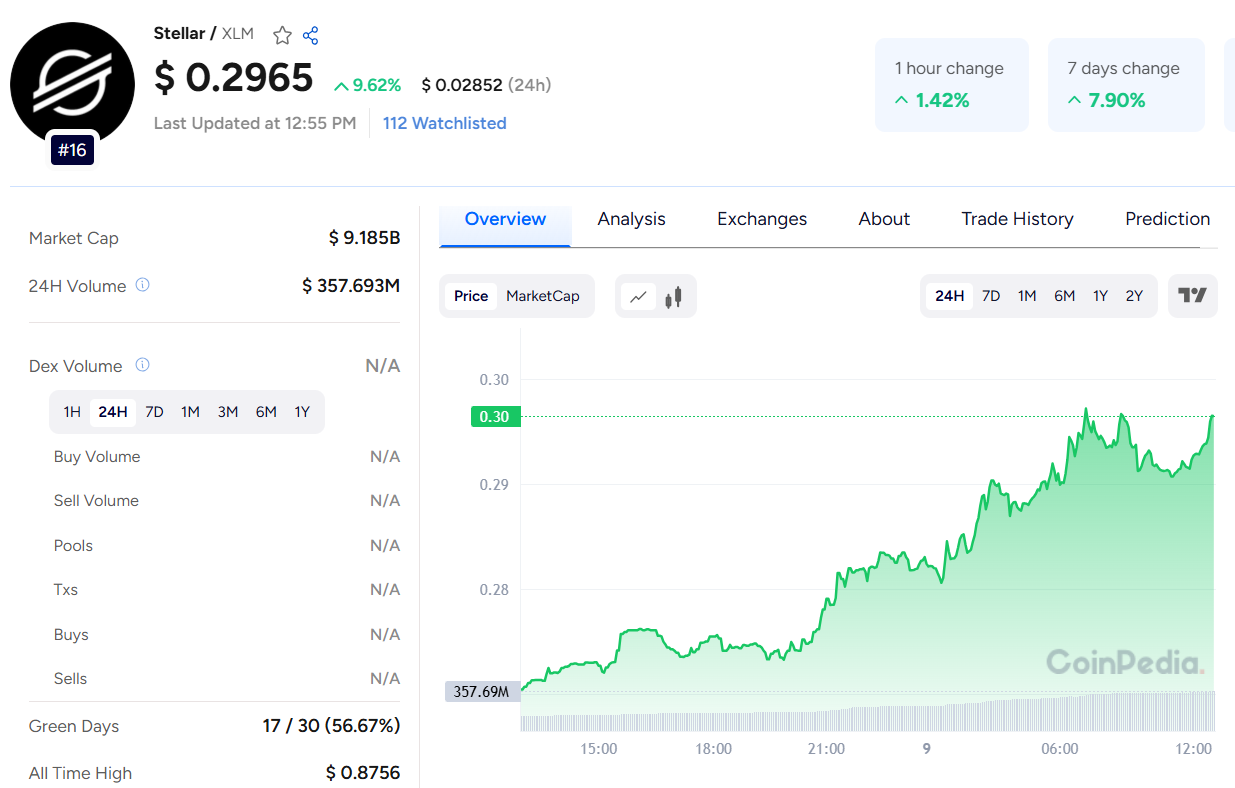

Stellar (XLM) has posted solid gains recently, climbing 10% in the past 24 hours and over 25% in the past month. However, the token still hovers below the critical $0.30 mark — a psychological barrier it hasn’t reclaimed since March 2025. Despite the strong uptrend, XLM faces stiff resistance at $0.279, which it must breach before aiming for a clean break above $0.30. Given this setup, the Stellar price prediction remains cautiously optimistic, hinging on whether bulls can overcome these near-term hurdles.

Key technical indicators suggest growing bullish momentum. Most notably, the Relative Strength Index (RSI) has surged from 31.47 to 62.21 within two days — a significant shift that points to renewed buying interest. An RSI above 50 typically indicates bullish strength, and with XLM now approaching 70, buyers appear to be regaining control. However, caution is warranted, as readings above 70 could signal overbought conditions, often leading to short-term pullbacks or consolidation.

Supporting this trend is a rebound in the Chaikin Money Flow (CMF), which rose from -0.32 to 0.04, signaling a return to positive buying pressure. While encouraging, the CMF remains below the 0.10 level — the threshold typically associated with strong accumulation. This suggests that while investor sentiment is improving, significant capital inflows are still lacking.

Also Read: Neo Price Prediction 2025, 2026 – 2030

Another bullish signal to watch is the potential formation of a golden cross — when the 50-day moving average crosses above the 200-day moving average — often seen as a long-term bullish indicator.

In summary, XLM is showing signs of a potential breakout, but key levels must be cleared. A close above $0.279 followed by sustained momentum past $0.30 would confirm the next leg up. Until then, traders should monitor RSI and CMF closely, as they’ll offer clues on whether this rally has staying power.

Servicio de atención al cliente por UserEcho