POPCAT (SOL) Eyes $1 Amid Viral Surge and Exchange Listing Rumors

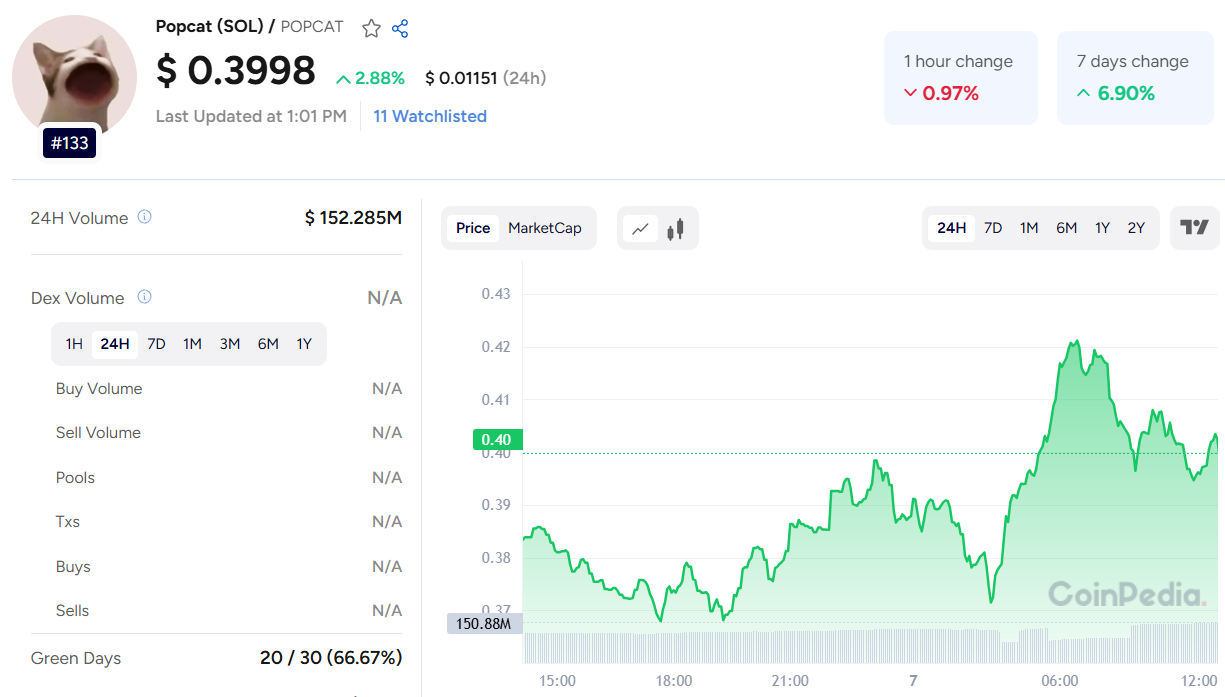

Popcat (POPCAT), the Solana-based meme token, is showing signs of renewed momentum as it trades at $0.3998, backed by a significant 24-hour trading volume of $152.3 million. Although the token saw a slight dip of -0.97% in the past hour, it is still up 2.86% over the last 24 hours, suggesting a bullish undercurrent supported by strong community activity and market developments.

The token’s circulating supply stands at 979.97 million, with a near-max supply already issued. The 50-day SMA of $0.2591 indicates strong short-term growth, while the 200-day SMA of $0.6946 reveals room for longer-term upside if momentum continues — a trend that’s fueling optimistic Popcat price prediction 2025 discussions within the community.

What’s Fueling the POPCAT Rally?

-

Viral Community Growth

POPCAT’s resurgence is largely driven by meme culture and influencer marketing across Asia. Platforms like TikTok and X have seen renewed interest from creators in Thailand, Malaysia, and Korea, while micro-content dApps are integrating POPCAT for in-app tipping, further embedding it into the social web3 landscape. -

Exchange Listings Rumored

Speculation around listings on two major Asia-based centralized exchanges in mid-May has fueled bullish sentiment. If confirmed, these listings could improve liquidity and enable broader access for retail investors. -

Strong Cultural Appeal

Much like Dogecoin, Popcat benefits from a highly recognizable meme character. However, its modern UI, Solana integration, and mobile-first approach offer a fresh, frictionless experience for new users.

Also Read: PONKE Price Prediction 2025, 2026 - 2030

Community Sentiment

While influencers like @fuelkek tout a $1 price target and @deg_ape compare its trajectory to Fartcoin’s historic rise, analysts caution that such forecasts are speculative. More grounded voices like @WisdomMatic suggest a near-term target of $0.7, citing healthy chart structure and organic growth.

POPCAT’s blend of meme appeal, viral growth, and technical alignment positions it as one to watch. However, savvy investors should balance hype with solid entry strategies.

Customer support service by UserEcho