Is Ethereum About to Explode Past $2K?

Ethereum (ETH) is back in focus as it hovers just above the $1,800 level after correcting from a recent high of $1,840. Although the price briefly dropped to $1,733, bulls managed to recover, pushing ETH above a key bearish trendline and reclaiming the 100-hour Simple Moving Average. This move has raised hopes of a potential shift in momentum and sparked renewed interest in Ethereum price prediction discussions, especially around Ethereum price prediction 2025 scenarios.

Currently, Ethereum faces strong resistance near $1,815 and $1,840. A clear break above these levels could lead to a rally toward $1,850 and potentially $1,920. If that happens, ETH might even retest the $2,000 mark. However, the path forward is not without risk.

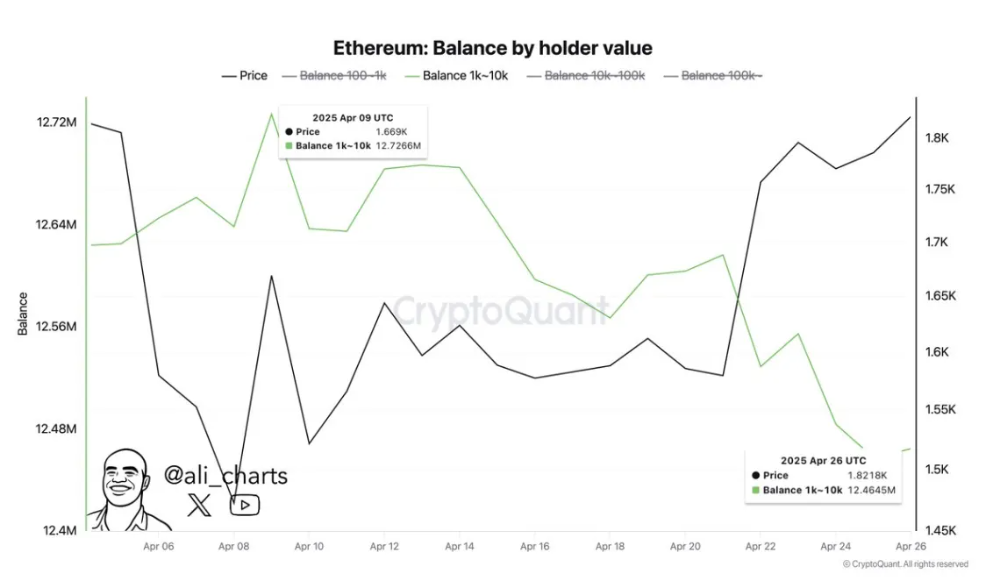

Whale activity has raised some caution. Data from analyst Ali Martinez shows that whales offloaded around 262,000 ETH—worth approximately $445 million—during the recent price surge. This sell-off suggests some larger players expect increased volatility or a possible pullback.

Also Read: Ronin Price Prediction 2025, 2026 – 2030

On a more positive note, Ethereum is retesting its long-term parabolic support zone. According to chartist Merlijn the Trader, this same zone supported ETH during its massive rally in 2017. He believes another explosive move could be brewing.

Two key signals support the bullish case:

- The price is holding above $1,750, keeping the bullish structure intact.

- Ethereum’s MVRV Z-Score has returned to its historical accumulation zone, often a sign of market bottoms.

If Ethereum breaks through immediate resistance and holds above $1,850, it could shift sentiment and attract further buying. On the other hand, failure to break out may lead to a retest of the $1,500–$1,600 demand zone.

For now, Ethereum remains at a crucial point—ready for a breakout but still shadowed by market uncertainty.

Customer support service by UserEcho