Ethereum Price Prediction: ETH Eyes $2,000 After Rally and Short Squeeze

Ethereum (ETH) recently broke above the key resistance level of $1,700 on April 22, gaining nearly 15% before facing rejection near $1,861. Since then, ETH has been trading between $1,740 and $1,800. As of Wednesday, the price hovers close to $1,800, with several technical and on-chain signals pointing to further upside potential. This movement has renewed focus on Ethereum price prediction.

Price Momentum and RSI

A break and close above the $1,861 resistance could push ETH toward the psychological level of $2,000. The Relative Strength Index (RSI) on the daily chart stands at 55, showing moderate bullish momentum and indicating that buyers still have strength.

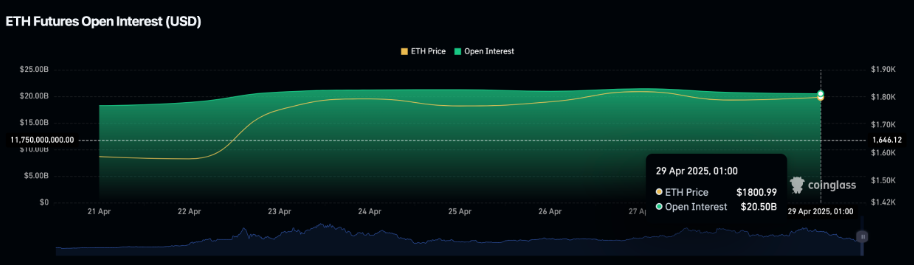

Drop in Open Interest Suggests Short Squeeze

According to Coinglass, Ethereum futures open interest dropped by $273 million, falling from $20.73 billion on Monday to $20.5 billion. This sharp decline, despite a 2% price increase, suggests that short traders closed large positions, possibly triggering a short squeeze. This closing of shorts may have added momentum to the spot market rally.

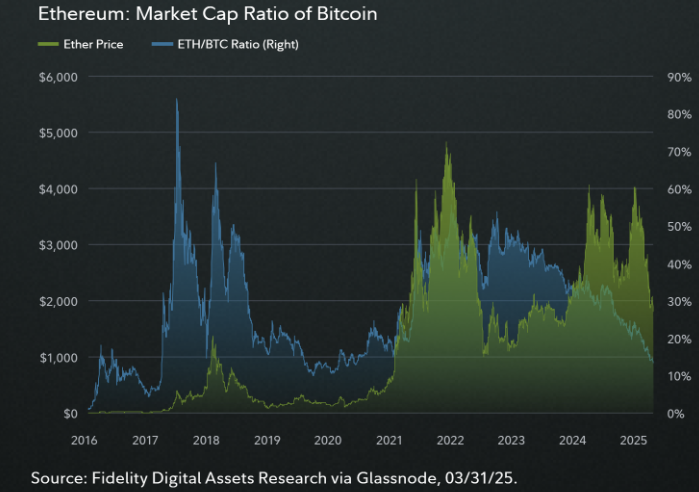

Undervalued Signals from On-Chain Metrics

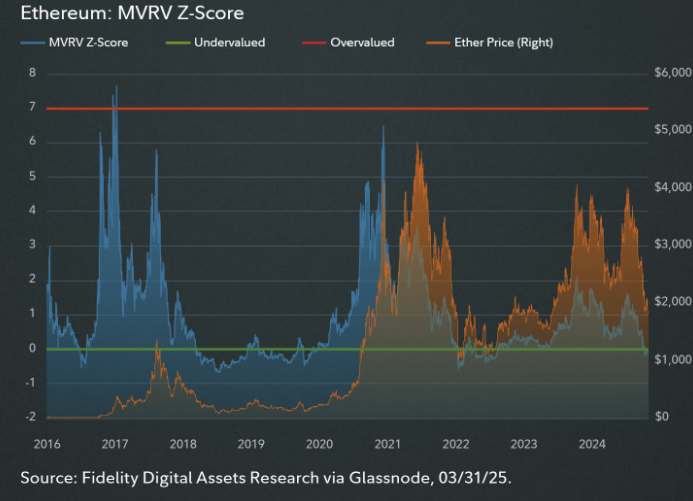

Fidelity Digital Assets reported that Ethereum’s MVRV Z-Score dropped to -0.18 in March, placing ETH in the “undervalued” zone. This level has often marked previous market bottoms.

Key on-chain insights include:

-

The Net Unrealized Profit/Loss (NUPL) ratio dropped to 0, signaling capitulation.

-

ETH’s realized price is $2,020—about 10% above the current market price—implying unrealized losses.

While this may seem bearish, it suggests long-term holders remain confident, possibly forming a support base. However, it's worth noting that ETH continued to decline below its realized price in 2022 before recovery.

ETH’s current consolidation and technical setup show promise, but traders should watch the $1,861 level closely. A breakout could lead to further gains, while rejection might invite short-term selling pressure.

Customer support service by UserEcho