Can XLM Price Break $1 in 2025 Bull Run?

Stellar (XLM) is gaining attention as its current price movement reflects a mix of consolidation and potential breakout signals. Traders and long-term holders are watching closely as both technical indicators and fundamental developments point toward significant price action in the coming weeks.

Key Resistance and Risk Levels

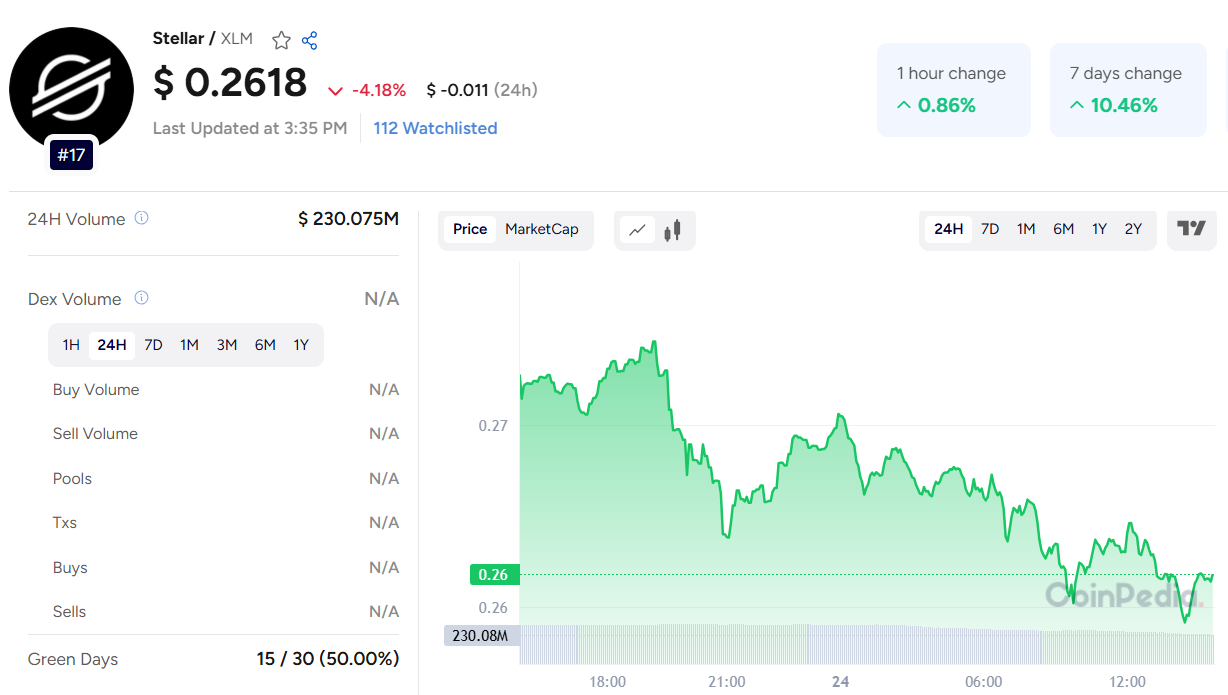

XLM is consolidating within a falling wedge pattern, a formation that often precedes a bullish breakout. The immediate resistance to watch is at $0.25. If XLM breaks above this level, it could rally toward $0.375, with a further potential upside to $0.514 based on historical chart patterns and recent momentum.

However, risks remain. A possible “death cross” — where the 50-day moving average dips below the 200-day — could trigger bearish sentiment. If support at $0.21 fails, XLM may decline to $0.19 or even $0.14. These levels are crucial for short-term traders watching Stellar price prediction models.

Technical Indicators Show Mixed Signals

-

The SuperTrend indicator, highlighted by analyst Ali Martinez, flashed a macro trend reversal signal on April 5. This is the first such signal since January 2022 and suggests a shift in long-term price momentum.

-

XLM is also forming an ascending triangle, often seen as a bullish pattern, pointing to a possible 15–17% price swing if upward pressure holds.

Real-World Adoption on the Rise

Stellar recently announced a strategic partnership with AEON Group, South Asia’s largest retail firm. This collaboration will allow AEON stores in Malaysia to accept XLM payments starting in the second half of 2025. The move is expected to increase utility and demand for the token, strengthening its long-term value proposition.

Also Read: Chiliz Price Prediction 2025, 2026 - 2030

Competitive Pressure and Market Challenges

XLM isn’t alone in the race. XRP is also expanding in Asia through a partnership with HashKey Capital to launch an institutional tracker fund. This intensifies competition within the region’s growing blockchain payments space.

Meanwhile, broader market conditions pose challenges. Global trade tensions and regulatory uncertainties continue to impact investor sentiment. XLM’s strong correlation with Bitcoin means it remains susceptible to wider market swings.

Despite headwinds, Stellar’s blend of promising technical setups and expanding real-world use cases presents a bullish case. As global crypto adoption grows, XLM appears well-positioned to benefit—especially if investor accumulation continues and macroeconomic stability improves.

Customer support service by UserEcho