Ethereum Holds Steady Above $1,500: Signs of Accumulation and Network Evolution

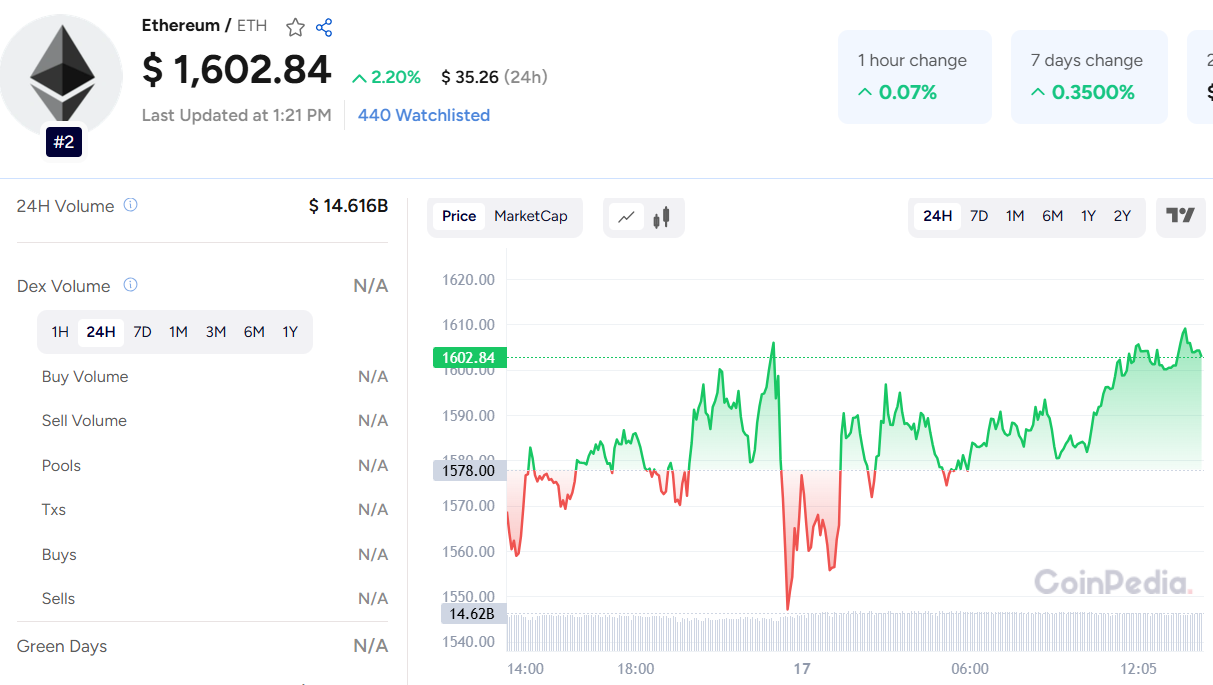

Ethereum (ETH) has been holding firm above the $1,500 mark, showing minimal volatility over the past 24 hours — a calm that often precedes meaningful market shifts. What’s catching attention isn’t the price itself, but the positioning of ETH near its realized price of $1,525, a zone historically known for marking deep-value accumulation.

Read Ethereum Price Prediction for more insights

According to CryptoQuant analyst abramchart, every major Ethereum bull cycle has begun once prices approached or dipped below this realized price. This technical pattern signals ETH could be entering its next accumulation phase — the typical foundation for future rallies.

Adding to this picture, Ethereum’s transaction fees have plummeted to $0.168, the lowest level since 2020, per Santiment. While fee drops often reflect lower network demand, history shows they frequently precede sharp price reversals. Lower congestion isn’t necessarily bearish — it can mark the final stages of market apathy before renewed interest returns.

This fee decline is partly the result of the Dencun upgrade launched in early 2024, which enhanced data handling through data blobs. While this improved scalability, it reduced Layer-1 gas revenue, signaling a structural evolution rather than pure market weakness.

Also Read AIOZ Network Price Prediction 2025 - 2030

Looking ahead, the Pectra upgrade, slated for May 7, is expected to double Layer-2 blob capacity, cut fees even further, and introduce the ability to pay network fees using stablecoins like USDC and DAI. Additionally, staking limits will expand from 32 ETH to 2,048 ETH, opening the door for larger validators.

For seasoned crypto investors, these developments suggest Ethereum is quietly setting the stage for its next growth cycle — both on the technical chart and within its protocol roadmap.

Customer support service by UserEcho