Ethereum Price Prediction: Potential 20% Surge in Coming Weeks

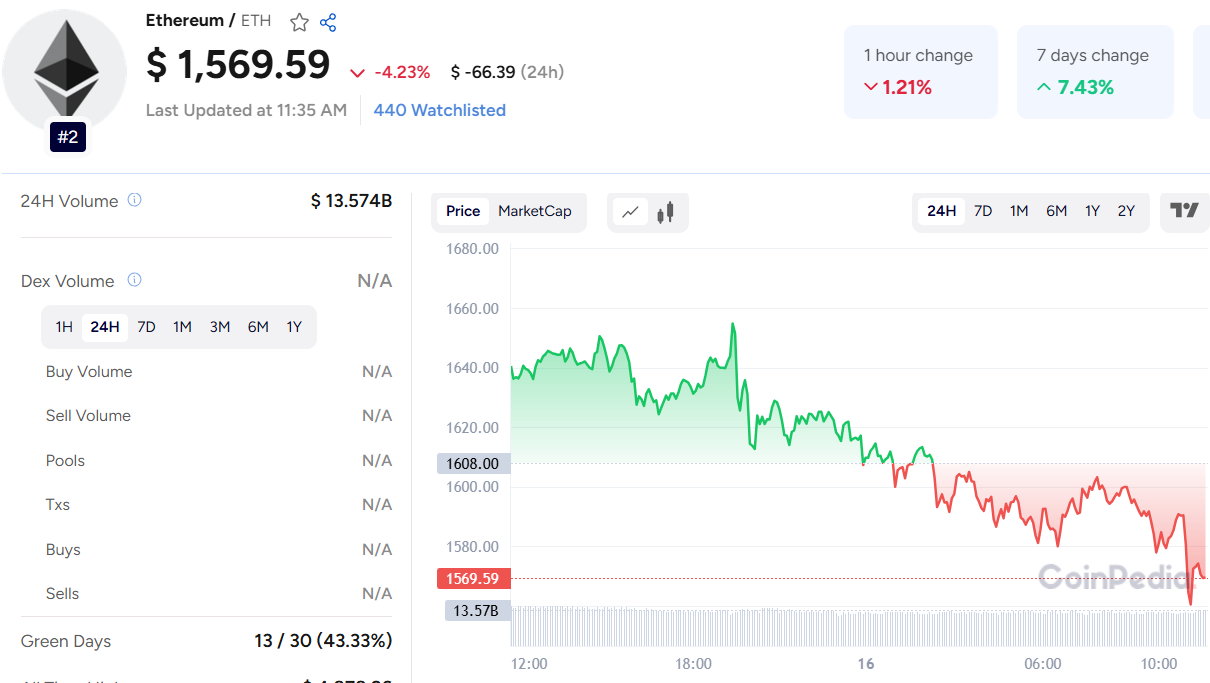

Ethereum (ETH) recently found support at the key daily level of $1,449, offering temporary relief after continued bearish pressure. The asset managed a slight recovery, climbing toward $1,700, but failed to break through. On Monday, ETH was once again rejected at this resistance level and declined by 2.15% the next day. As of Wednesday, ETH trades around $1,590.

Based on the current Ethereum price prediction, if this correction deepens, ETH could retest the $1,449 support. A daily close below this critical level may push the price lower toward the psychological support of $1,300. The RSI on the daily chart sits at 40, well below the neutral 50, signaling prevailing bearish momentum.

However, a break and close above $1,700 could invalidate the downtrend and drive ETH toward the next resistance near $1,861.

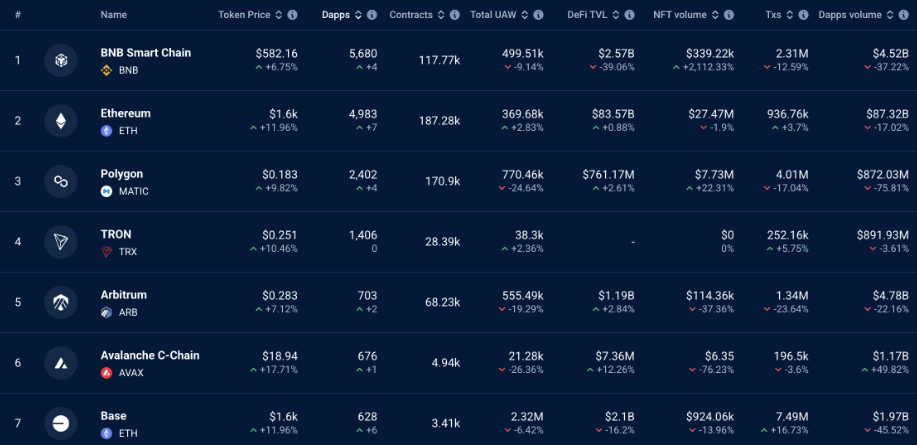

Beyond price action, Ethereum continues to dominate in DApp fee revenue. As the first blockchain to support smart contracts, Ethereum laid the groundwork for its expansive DApp ecosystem. As per DappRadar, Ethereum hosts over 4,983 active DApps—second only to BNB Chain.

Despite high mainnet fees, Ethereum’s upgrades, including Dencun in 2024, have significantly improved Layer-2 performance and reduced costs. This has contributed to Ethereum’s ongoing developer interest and network activity.

According to DefiLlama, Ethereum’s DeFi ecosystem holds $46 billion in Total Value Locked (TVL), accounting for 51% of the DeFi market. Other chains are growing—Coinbase’s Base generated $193 million in DApp revenue, a 45% increase since Q4 2024. BNB Chain followed with $170 million, while Arbitrum and Avalanche trailed with $73.8M and $27.68M respectively.

While the price battles key levels, Ethereum’s ecosystem strength reinforces its long-term value proposition in the crypto space.

Сервис поддержки клиентов работает на платформе UserEcho