ETH Price Eyes 17% Move in Symmetrical Triangle

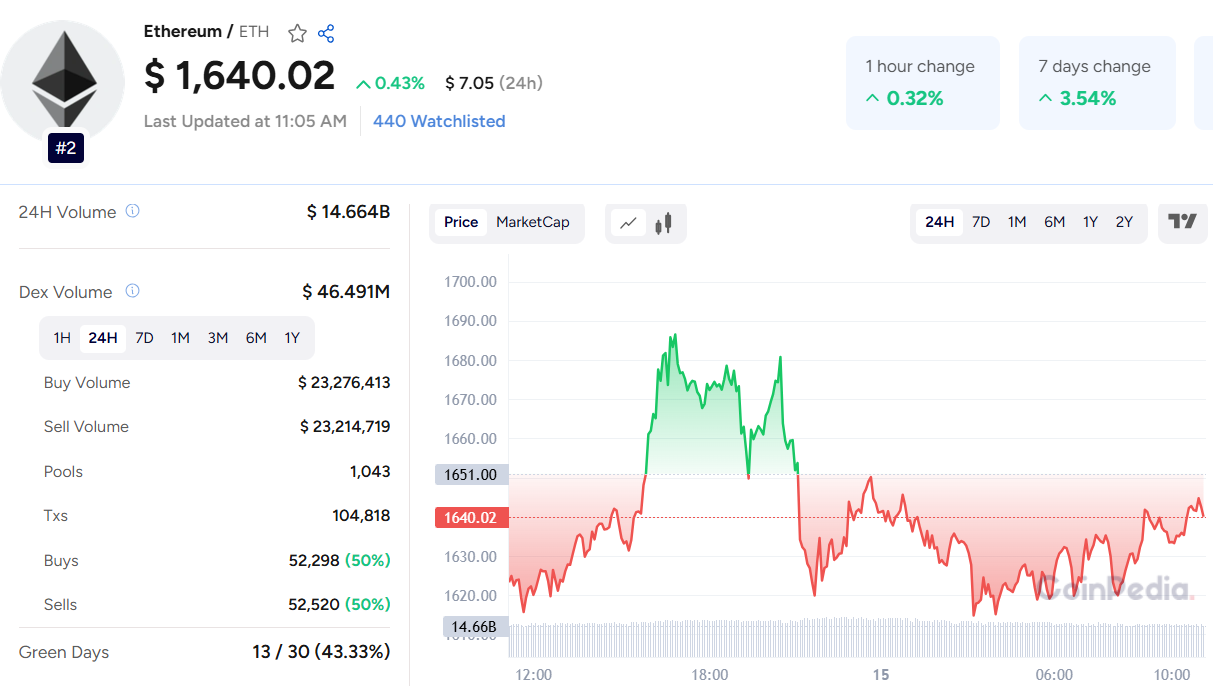

Ethereum (ETH) is showing signs of brewing volatility, as the price consolidates within a symmetrical triangle on the hourly chart — a classic setup often referenced in Ethereum price prediction models, hinting at an imminent breakout. The cryptocurrency is currently trading near $1,625, holding steady above the key $1,580 support zone.

ETH’s higher lows and lower highs are tightening the range, with the Relative Strength Index (RSI) sitting at a neutral 56.17. The MACD, however, has flashed a bullish crossover, suggesting growing buying interest despite market hesitation.

A decisive break above the $1,665 resistance could spark a potential 17% rally, with $1,750 and $1,800 emerging as immediate targets. Conversely, failure to hold above $1,580 could drag prices lower toward $1,500 or even $1,420 — levels that would mark a significant retracement.

Adding to the market tension, the U.S. SEC has delayed its decision on allowing staking within Grayscale’s ETH ETFs. The extended deadline, now set for June 1, 2025, offers the Commission more time to assess the proposal, especially as the agency transitions leadership to pro-crypto nominee Paul Atkins.

Also Read: Sonic Price Prediction 2025, 2026 – 2030

Analysts, including Bloomberg’s James Seyffart, anticipate the staking approval will likely arrive once Atkins assumes office. Should staking get the green light, ETH ETF products could see revived inflows, reversing the persistent outflow trend recorded since February.

Interestingly, inverse ETH ETFs like T-Rex 2X (ETQ) and ProShares UltraShort Ether (ETHD) have outperformed in 2025, posting impressive year-to-date gains of 148% and 162%, respectively.

With both technical and regulatory catalysts aligning, seasoned investors are keeping a sharp eye on Ethereum’s next big move — as the triangle apex approaches, so does the potential for a breakout.

Service d'assistance aux clients par UserEcho