Ethereum Just Crashed Below $1,450 — Time to Panic or Buy the Dip?

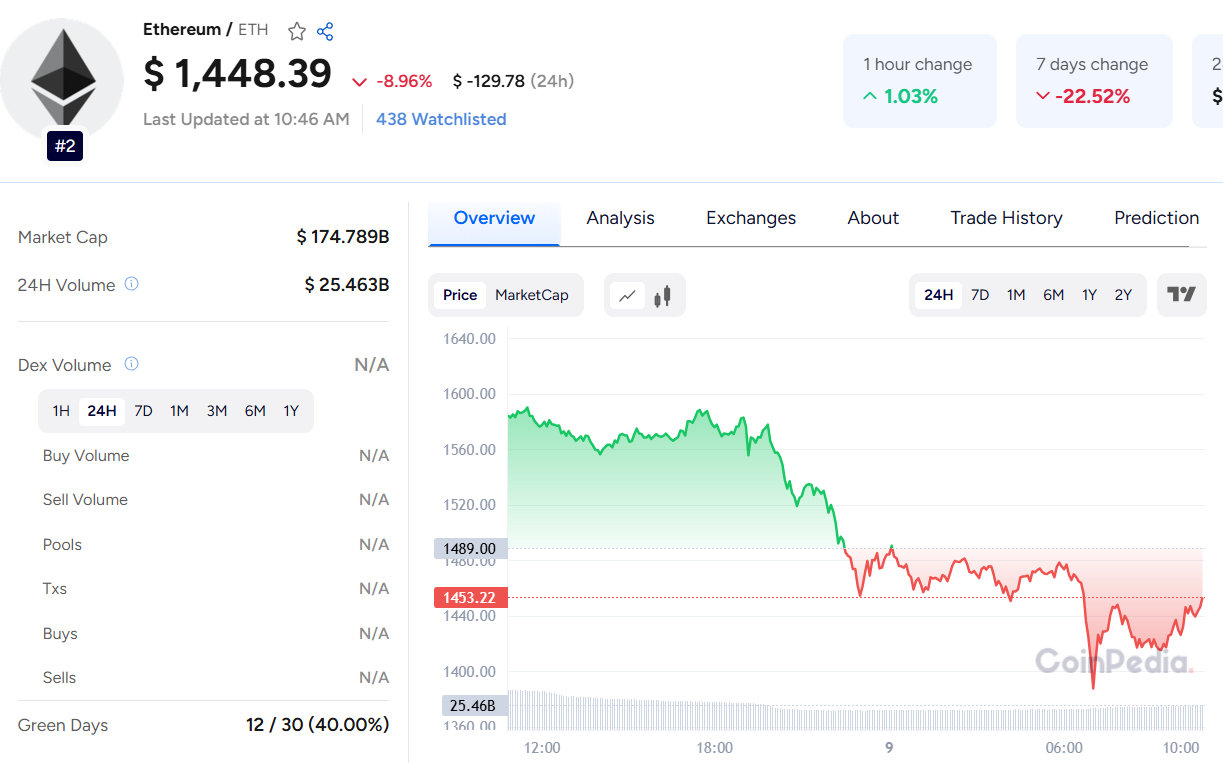

Ethereum (ETH) saw a sharp 13% decline last week after failing to break above the $1,861 resistance level. This week, the downtrend continues, with ETH shedding nearly 7% by Tuesday. By Wednesday, it had broken below its crucial daily support at $1,449 — a level not seen since October 2023.

Read Ethereum Price Prediction For More Insights

If Ethereum closes below this support, it could pave the way for a deeper correction toward the psychological level of $1,300. The Relative Strength Index (RSI) sits at 23, well below the oversold threshold of 30, suggesting ETH may be undervalued. However, in strong downtrends, RSI can remain oversold for extended periods.

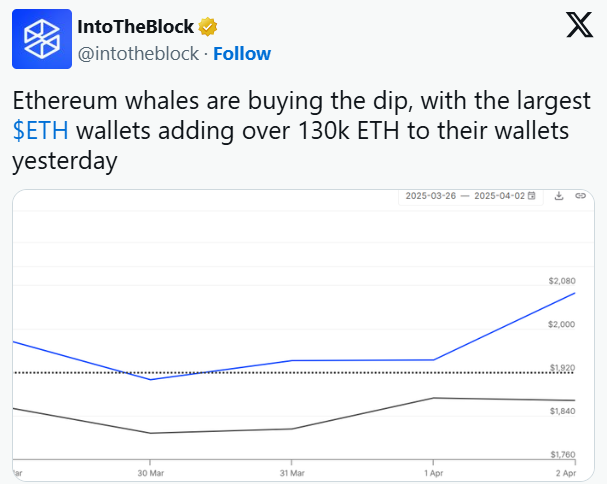

On the flip side, if bulls step in and the price rebounds, ETH could retest the $1,700 level. Whale activity hints at possible accumulation. According to IntoTheBlock, over 130,000 ETH was scooped up on Wednesday after prices dropped below $1,800 — their lowest since November 2024. Lookonchain also reported a whale purchase of 6,488 ETH at $1,772.

The broader crypto sell-off is largely tied to macro uncertainty. On April 2, former President Trump announced sweeping US trade tariffs, igniting “risk-off” sentiment across markets. This policy shift has led investors to pull back from risk assets, including both stocks and cryptocurrencies.

Also Read: Tron Price Prediction 2025, 2026 – 2030

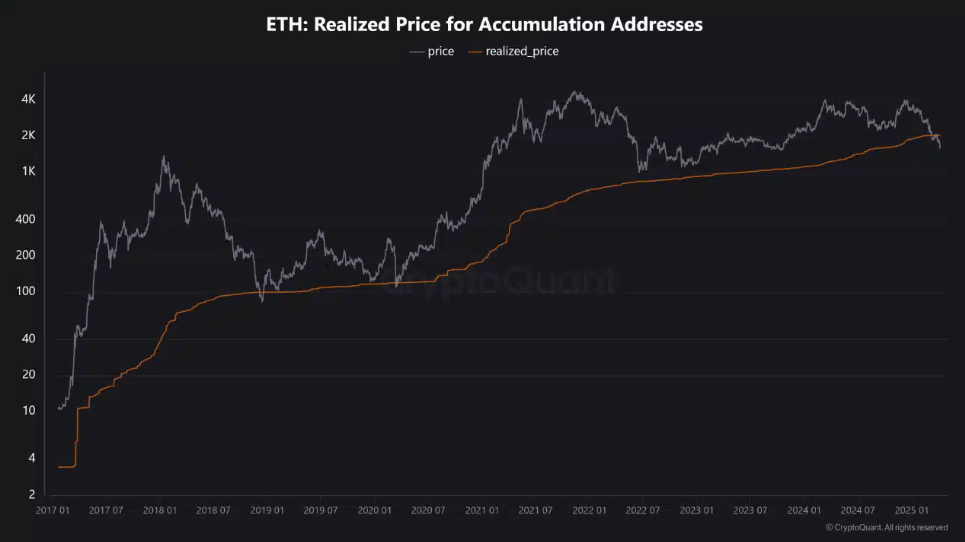

For the first time in over a year, ETH's market price has dipped below the realized price for accumulation addresses. Historically, such events signal deep stress — but also tend to mark capitulation zones and long-term bottoms.

With ETH hovering under key levels and long-term holders accumulating, the current drop may not just reflect fear — it could also represent a stealth buy opportunity for those with a longer time horizon.

Customer support service by UserEcho