Ethereum Whale Drops $47M Long Bet as ETH Price Crashes to $1.4K

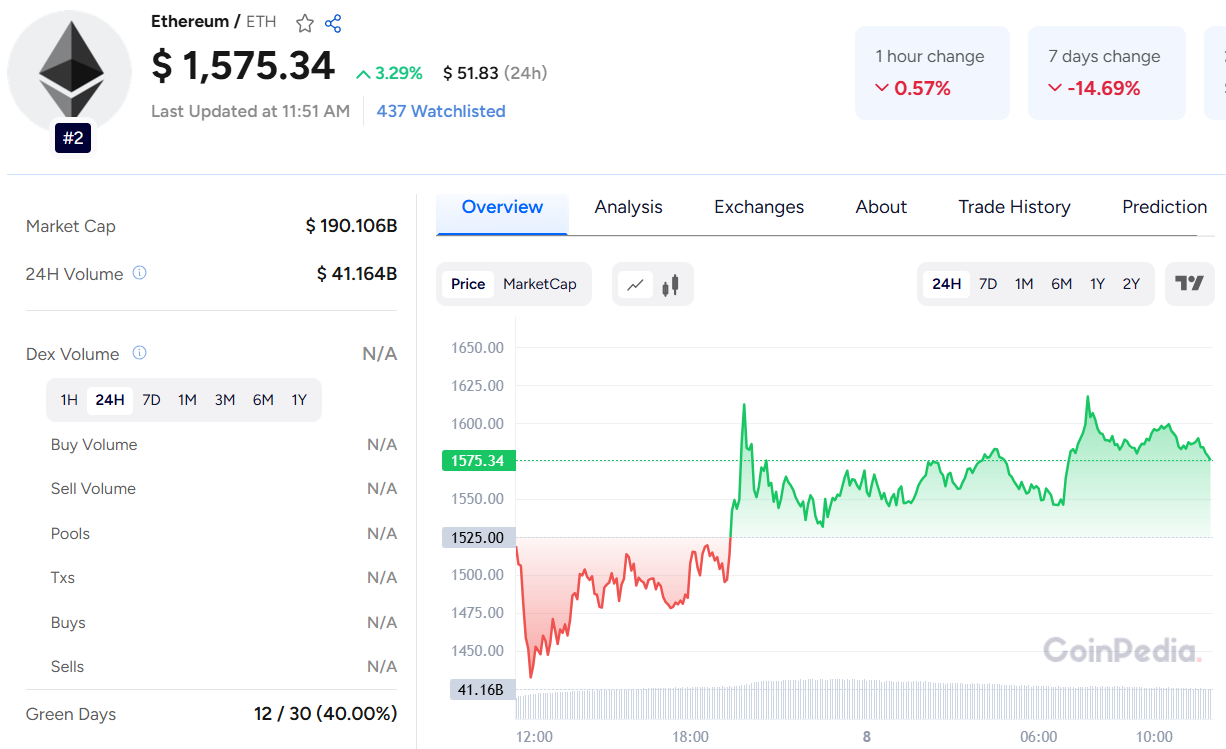

Ethereum (ETH) has experienced a brutal 27% drop over the past 48 hours, sinking to a two-year low of $1,410 before staging a slight rebound above $1,500. This sharp decline mirrors Bitcoin’s losses and highlights growing market anxiety.

Read Ethereum Price Prediction for more detailed insights

The ETH/USD pair fell through key support levels at $1,700, $1,650, and $1,620, with bears taking control. The price now trades below the 100-hour SMA and faces strong resistance at $1,615 and $1,660. A bearish trendline and the 50% Fib retracement from $1,815 to $1,410 reinforce this zone. A decisive move above $1,720 could open the door to $1,820 and even $1,920.

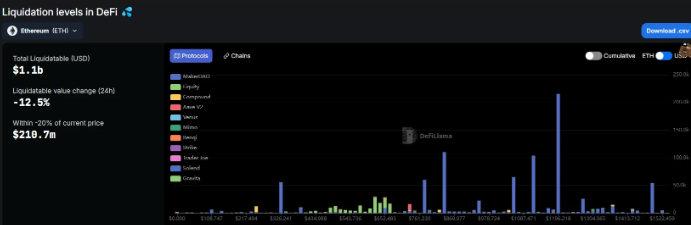

Liquidations have intensified. Coinglass data reveals $257.87 million in ETH derivatives wiped out during the crash, with $367 million more liquidated in the DeFi sector. A major borrower on Maker lost 65,570 ETH, and another holding 56,995 WETH was also liquidated. Over $1.1 billion in ETH collateral is now at risk across DeFi protocols.

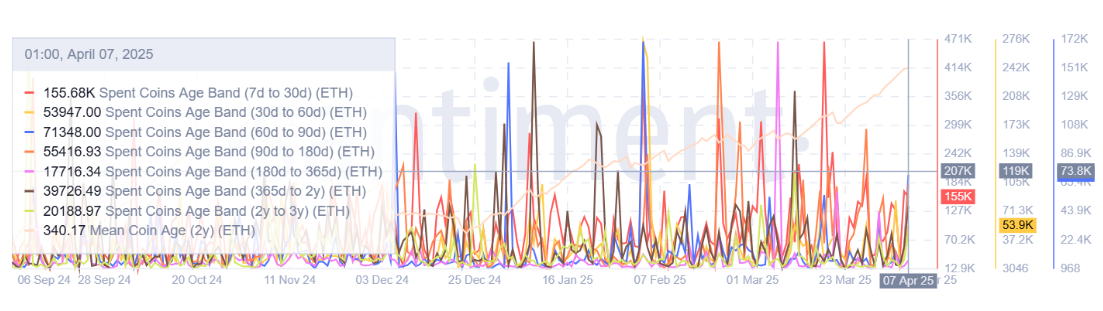

On-chain data shows investor capitulation. Realized losses have surpassed $500 million, largely driven by short-term holders. Even 1-2 year holders are slowly joining the selling pressure. This sentiment shift is echoed by a $31 million outflow from Grayscale’s ETHE and $49.93 million pulled from ETH ETFs last week.

Also Read: VeChain Price Prediction 2025, 2026 – 2030

Yet, whales remain active. One entity opened a $47.59 million long at $1,461, despite being down nearly half a million dollars. Another, dubbed “Seven Siblings,” added 24,817 ETH during the dip, holding 98% of their $603M portfolio in ETH.

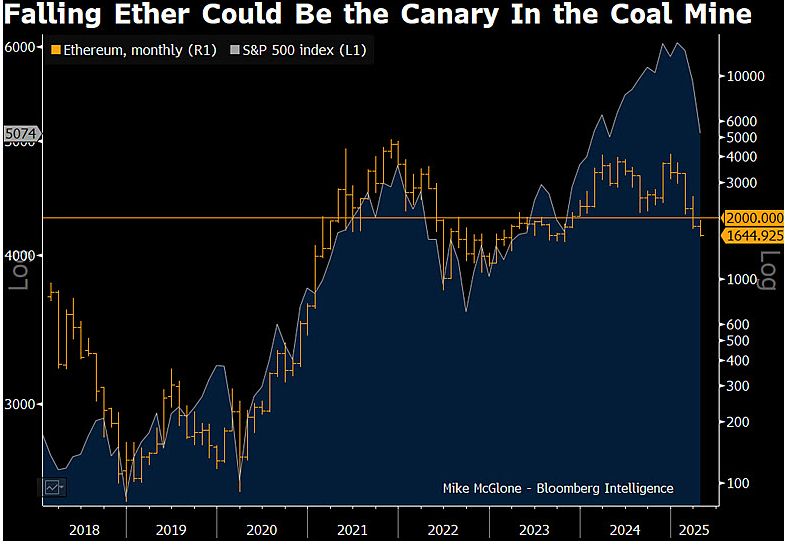

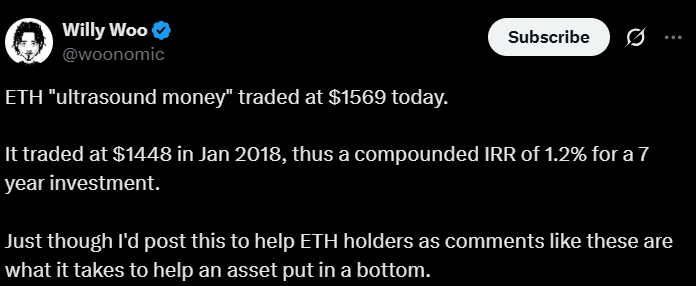

While Ethereum’s long-term returns are now under scrutiny, especially with its IRR down to 1.2%, some view this correction as a pivotal moment—either a breakdown or a prime accumulation opportunity.

Customer support service by UserEcho