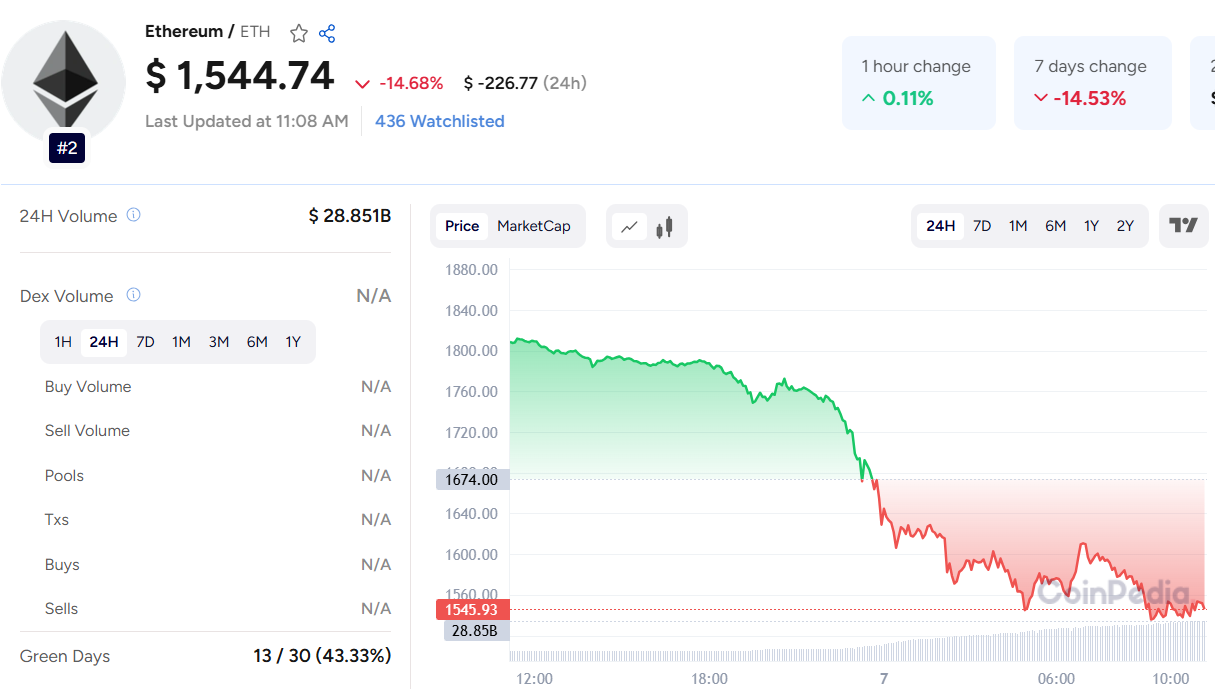

What’s Ethereum’s Next Move After $1,500?

Ethereum (ETH) has seen a sharp 14% drop in the last 24 hours, now trading just above the crucial $1,500 level. This decline marks a deeper correction, with ETH shedding nearly 45% of its value in Q1 2025—far worse than Bitcoin’s 14.67% drop, according to IntoTheBlock data.

Read Ethereum Price Prediction For More Details

Technically, Ethereum’s outlook has turned bearish. The asset is now trading below its 200-day simple moving average ($2,500) and exponential moving average ($2,250), both of which were critical support zones. Its Relative Strength Index (RSI) sits at 27, deep in oversold territory, typically a signal for a possible bounce. However, analysts warn that a prolonged selloff may keep the RSI suppressed for longer. The MACD also shows a bearish crossover, indicating further downside.

If selling pressure continues, ETH could revisit support levels at $1,420 and $1,350. On the upside, resistance is stacked at $1,600, $1,675, and $1,710, with heavy selling expected at each level.

The broader market uncertainty—driven by global risk aversion and Trump’s renewed trade war rhetoric—is hurting investor sentiment. Even the S&P 500 has outperformed Ethereum this quarter, highlighting ETH’s relative weakness.

Also Read: Stacks Price Prediction 2025, 2026 – 2030

Exchange reserves have dropped to a three-year low of 18.4 million ETH, according to CryptoQuant. Typically seen as bullish (suggesting reduced selling pressure), this drop hasn’t led to a price rebound. Instead, it signals possible investor fatigue, passive holding, or an exit from Ethereum altogether.

While Bitcoin is regaining its image as a safer digital asset, Ethereum appears to be losing investor trust. For now, all eyes are on the $1,500 support level. A breakdown here could trigger a deeper slide, while a recovery remains capped by stiff resistance overhead.

Customer support service by UserEcho