SOL Price To $150? Coinbase Expands to Solana Futures Product

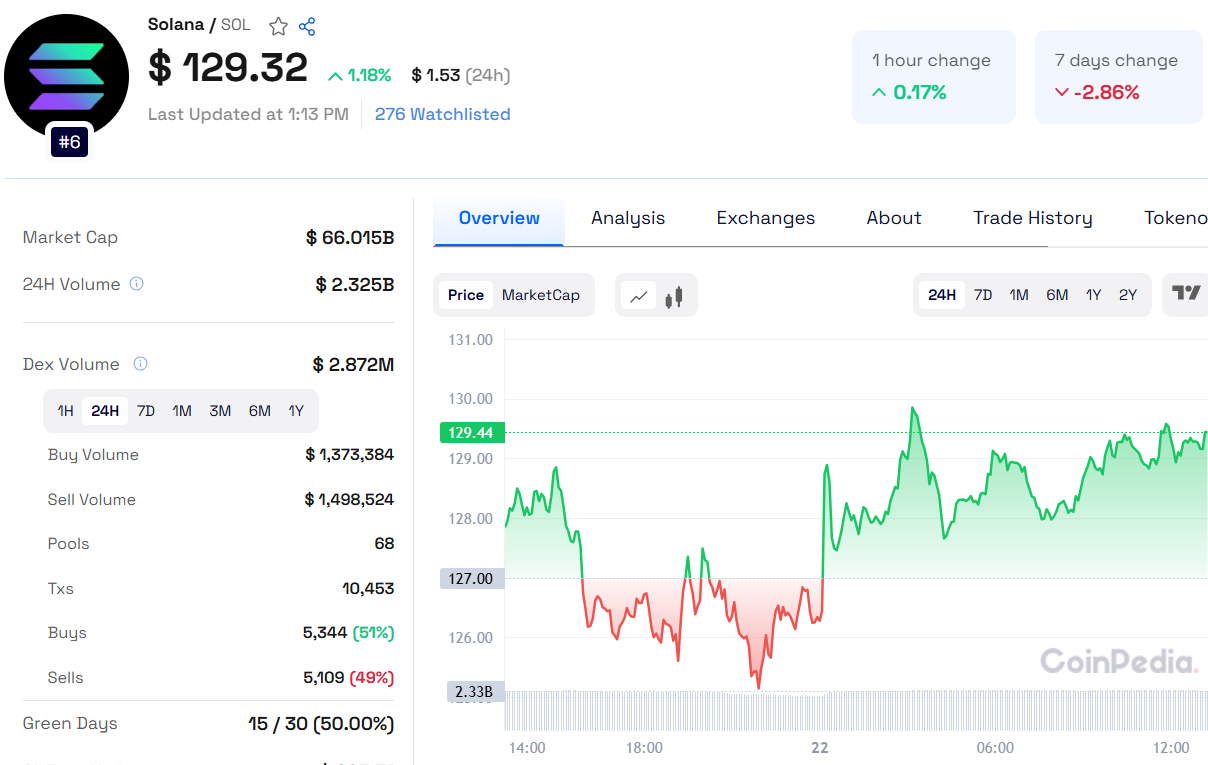

Solana (SOL) is currently trading at $129.44, with a 24-hour trading volume of $2.32 billion. Over the past hour, SOL has declined by 0.37%, and since yesterday, it has dropped 1.22%. Technical indicators suggest that Solana may soon experience a bearish breakdown as the price has formed a bearish flag pattern, a well-known continuation signal for downward trends.

Read Solana Price Prediction for detailed insights

Bearish Technical Signals

Solana's price remains below all major moving averages, indicating weakness. Additionally, oscillators like the RSI and MACD are pointing downward, reinforcing a bearish sentiment. If SOL falls below the key support level at $120, the next potential target could be $100.

Growing Network Adoption

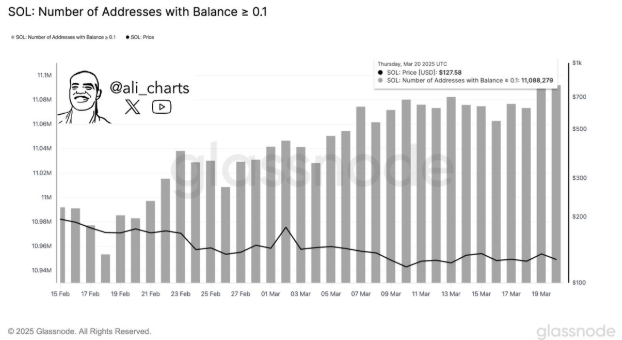

Despite short-term bearish signals, Solana has reached a new all-time high (ATH) in network adoption, with 11.09 million unique addresses now holding SOL tokens. This surge in address activity signals increased user participation and confidence in Solana’s ecosystem, which could have a long-term positive impact on the token's price.

Also Read: AMP Price Prediction 2025, 2026 – 2030: Will AMP Hit $0.050?

Institutional Interest and ETFs

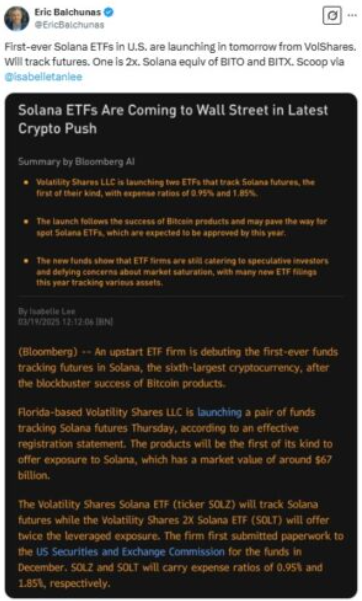

One major driver of Solana’s adoption is growing institutional interest. The recent proposal for Solana futures ETFs (SOLZ and SOLT) by Florida-based Volatility Shares is a major step. If approved, these funds will offer investors exposure to Solana’s price movements, with SOLT providing 2x leverage.

Future Outlook

While Solana faces short-term bearish risks, its strong adoption metrics and increasing institutional involvement provide a bullish long-term perspective. If a spot Solana ETF gains regulatory approval, SOL could experience new all-time highs. However, traders should monitor the $120 support level closely, as a breakdown could lead to further declines.

Customer support service by UserEcho