Can Toncoin Price Break Past $3.66 Resistance?

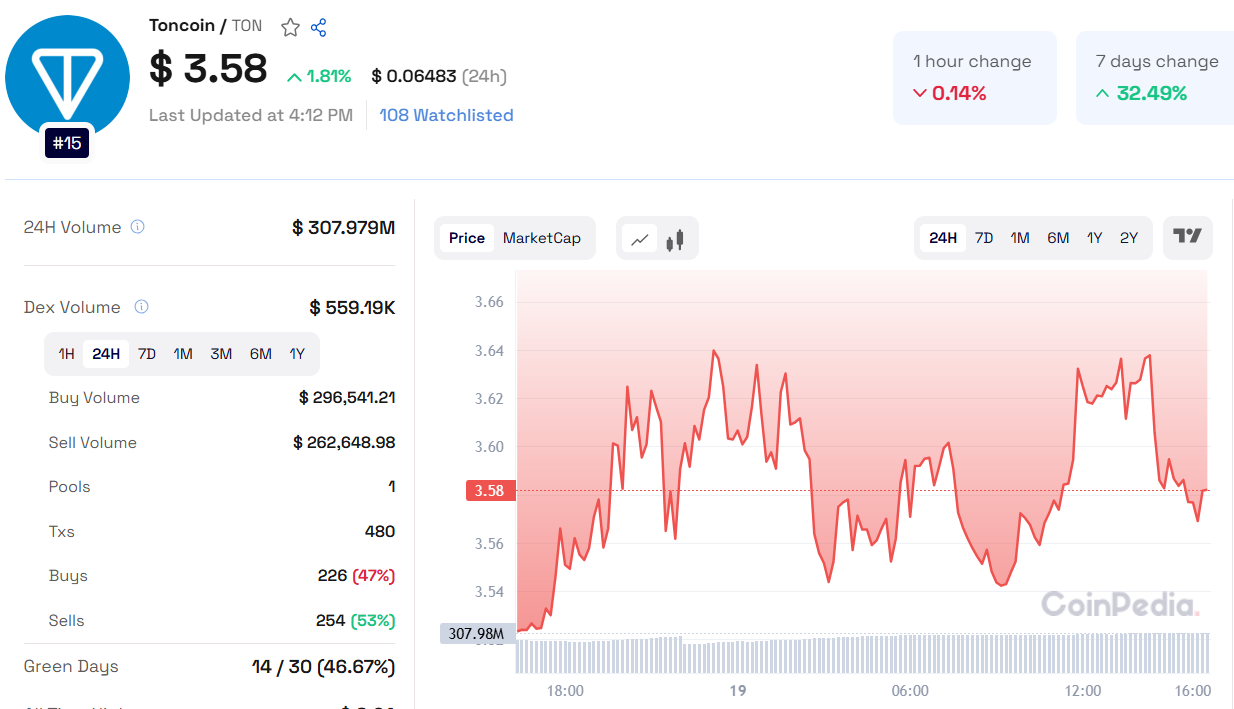

Toncoin (TON) is currently trading at $3.58, with a 24-hour trading volume of $307,979,338. Despite a 2.18% increase over the past day, the cryptocurrency is experiencing signs of exhaustion after its recent surge from $2.59 to $3.66. A cooling-off phase has set in, with the price stabilizing around $3.41, reflecting a minor 0.27% decline from the previous day.

Read TON Price Prediction 2025. 2026 - 2030

Technical Indicators Suggest Momentum Slowdown

Toncoin’s Relative Strength Index (RSI) has dropped to the 50-mean level, signaling a lack of strong momentum. Additionally, the On-Balance-Volume (OBV) indicator shows weak buying pressure, indicating that the recent rally was not backed by significant volume. Prices touching the upper Bollinger Band suggest overbought conditions, which could lead to a pullback.

Key resistance levels to watch are $3.661 and $3.768, while support levels lie at $3.334 and $3.129.

Also Read: THORChain Price Prediction 2025, 2026 – 2030

On-Chain Data Raises Concerns

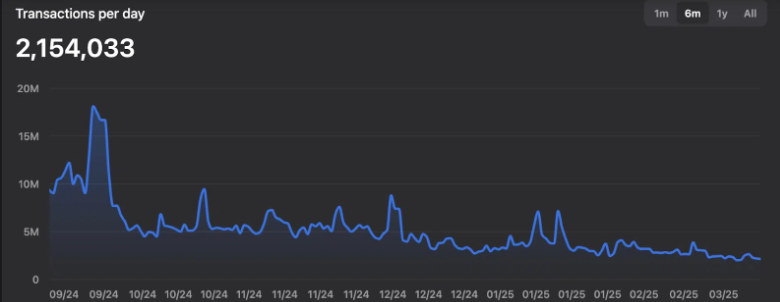

Despite its rally, Toncoin faces fundamental challenges. Token inflation has increased from 0.33% in October to 0.40%, adding supply pressure. Daily transactions have plummeted from nearly 20 million in September to 2.15 million, reflecting reduced network activity.

Furthermore, Total Value Locked (TVL) in TON’s DeFi ecosystem has dropped from $800 million to $180 million, showing weakening engagement. Trading volumes on STON.fi, TON’s primary DEX, remain low at $7.1 million daily.

Open Interest Spikes: Bullish or Risky?

Toncoin’s open interest (OI) in derivatives has surged from $80.75 million to $169.12 million in just five days. While this suggests rising speculative interest, it also increases the risk of heightened volatility. If leveraged positions unwind, a sharp price decline could follow.

With growing market uncertainties and fundamental weaknesses, TON’s next move will depend on whether it can sustain buying interest and break key resistance levels.

Customer support service by UserEcho