Whale Dumps $43M OP! Will the Price Crash?

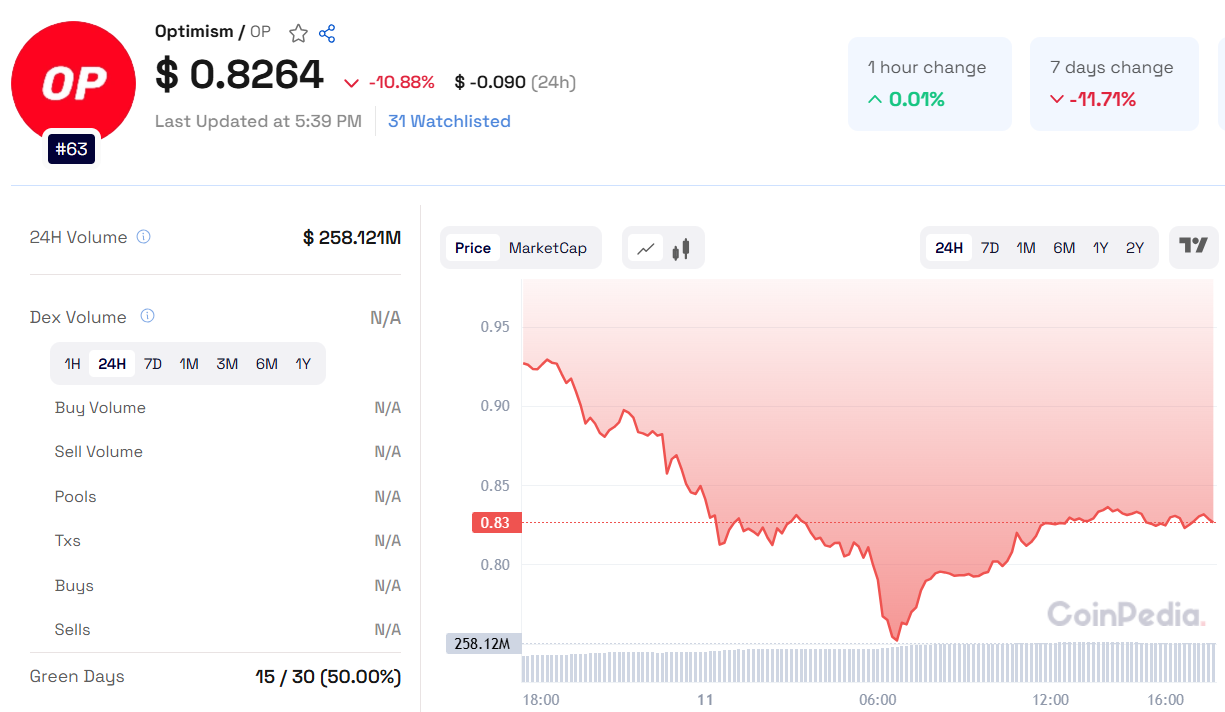

Optimism (OP) is currently trading at $0.8285, with a 24-hour trading volume of $259.08 million. The token has dropped -0.07% in the last hour and -10.35% since yesterday, showing significant short-term bearish momentum.

Read Optimism Price Prediction for more detailed insights

Market Performance and Trends

The circulating supply of OP stands at 1.62 billion, while the maximum supply is 4.29 billion OP. The 50-day Simple Moving Average (SMA) is $1.20, and the 200-day SMA is $1.66, indicating a persistent downtrend.

Optimism reached an all-time high (ATH) of $4.84 on March 6, 2024, and is now down -82.89% from that level. However, it remains up 105.99% from its all-time low (ATL) of $0.4022 on June 20, 2022, suggesting long-term recovery potential.

Also Read: FTT Price Prediction 2025, 2026 – 2030

Whale Activity and Market Impact

On-chain data highlights major whale activity, which could influence OP’s price further. A large holder unstaked 8.67 million OP after 281 days of dormancy and deposited 7 million OP ($43.45 million) to Binance. This whale originally withdrew 8.81 million OP from Binance on April 17, 2024, at $0.682 per token, before staking it.

The whale still holds 1.67 million OP ($10.2 million) and has accumulated a total profit of $47.64 million, representing a 793% gain. The large deposit raises concerns of increased selling pressure, which may drive the price lower if further sales occur.

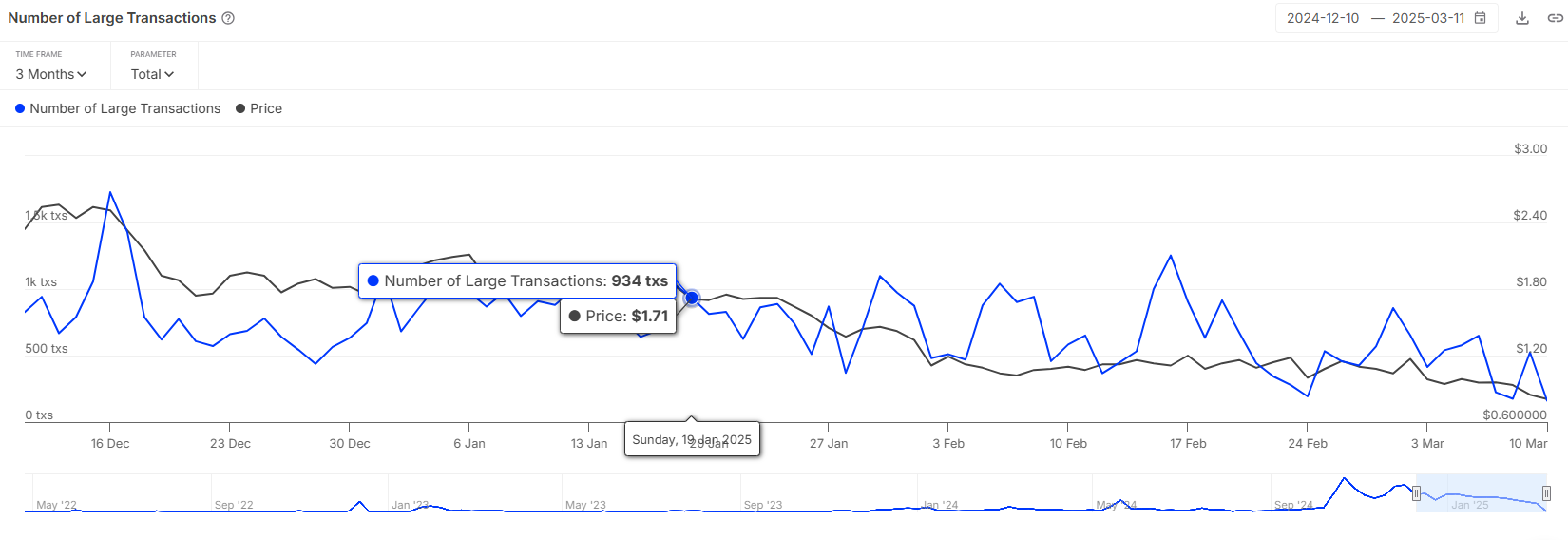

Large Transactions and Volume Trends

The number of large transactions in the past 24 hours is 161, marking the lowest level in a week. In contrast, the 7-day high was 649 transactions on March 6, 2025, indicating a sharp decline in whale activity.

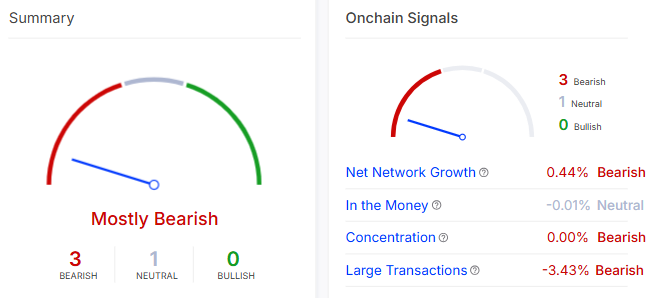

Optimism’s price remains under pressure, with on-chain indicators signaling bearish sentiment. The recent whale movement could lead to further sell-offs, impacting the price negatively. However, traders will closely monitor OP’s price action, especially around key support levels and moving averages, to assess whether the token can stabilize or face further downside.

Customer support service by UserEcho