0

Solana Price Dropped 25%—Time to Buy?

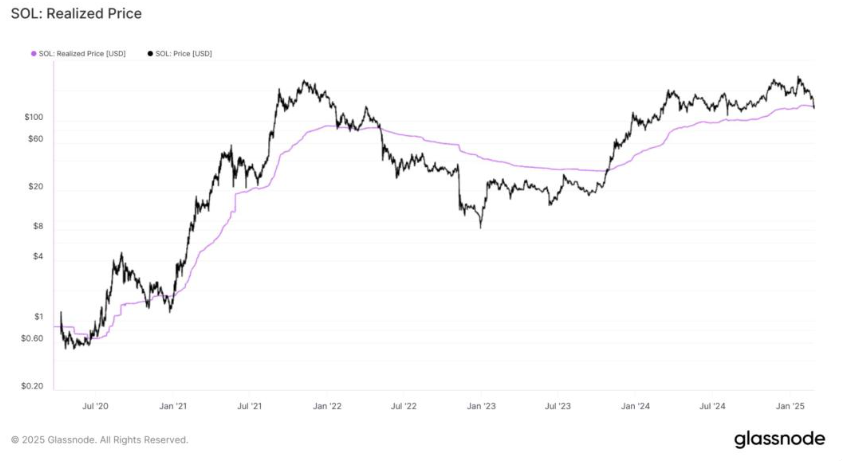

Solana (SOL) has reached a crucial price level, testing its Realized Price—a key on-chain metric that tracks the average cost basis of investors. A new analysis from CryptoVizArt.₿, a senior analyst at Glassnode, highlights this important development.

What is Solana’s Realized Price?

- The Realized Price represents the average cost at which investors acquired their SOL holdings.

- If the market price is above the Realized Price, holders are in profit.

- If the market price drops below the Realized Price, the majority of holders are in loss.

Read SOL Price Prediction for more detailed insights

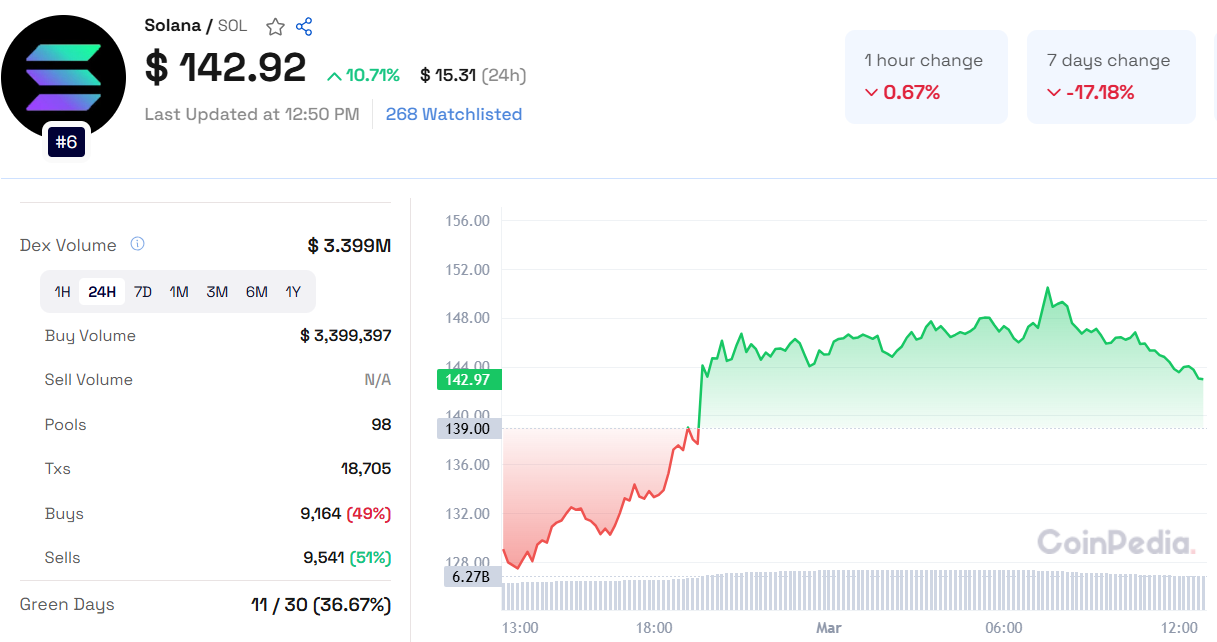

Current Market Situation

- SOL had been trading above its Realized Price for over a year, keeping investors in profit.

- A recent market-wide crash has pulled SOL back to this critical level, currently around $133.

- Over the last week, SOL has declined by more than 25%.

Why This Level Matters

- Historically, the Realized Price has acted as a strong support level.

- If SOL holds above this level, it may signal a potential rebound as investors buy the dip.

- A drop below this level could indicate a deeper market correction, similar to the 2022 bear market.

- In 2022, SOL hovered around this level for five months before breaking down and entering a prolonged decline.

Also Read: Bitcoin Cash Price Prediction 2025, 2026 – 2030: Will BCH Hit $1000?

Market Trends and Institutional Interest

- Open interest in Solana futures has fallen from $7.4 billion in mid-January to $3.7 billion by February 28, showing reduced leveraged positions and increased volatility.

- Despite market uncertainty, major investment firms like VanEck and Franklin Templeton have applied for Solana-based ETFs.

- ETF approvals take time, and there is no immediate catalyst driving SOL prices higher.

Solana is now at a decisive moment. Will it hold above the Realized Price and regain strength, or is a further decline ahead?

Customer support service by UserEcho