Can OP Price Drop Below $1? Shocking Signs!

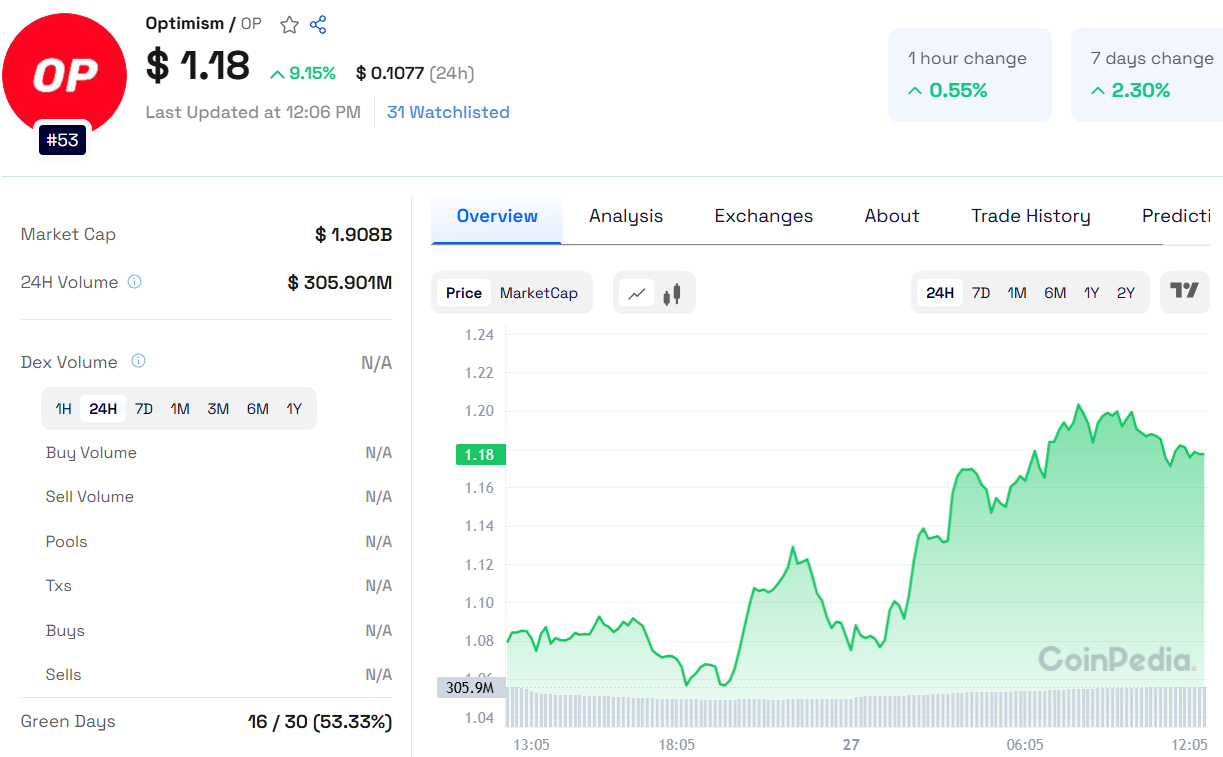

Optimism (OP) is currently navigating a crucial phase after forming a head-and-shoulders pattern, a historically bearish signal. With the price hovering near $1.10, investors are watching closely to see if OP will continue its downward slide or stage a recovery.

Head-and-Shoulders Pattern Signals Downside Risk

The bearish head-and-shoulders pattern has heightened concerns among traders. OP’s left shoulder peaked at $2.70, the head reached $4.50, and the right shoulder settled below $2.50. Since breaking below the neckline at $1.10, the price has been at risk of further declines. If the breakdown continues, OP could test lower support levels at $0.80 or even lower. However, if short sellers are forced to cover, OP might surge back above $1.50 in a short squeeze scenario.

Read Optimism Price Prediction for more insights

Investor Sentiment and Profitability Trends

Despite the recent dip, 54.89% of OP holders remain in profit, while 40.17% are in the red. This suggests a relatively strong investor base, which may prevent a mass sell-off. However, a crucial support level exists around $1.01, where many holders are at breakeven. If OP drops below $0.90, capitulation could accelerate, increasing selling pressure and reinforcing the bearish trend.

Network Activity: A Mixed Picture

OP’s network activity provides conflicting signals. Active addresses have risen by 7.38%, indicating sustained user engagement. However, new addresses have declined by 16.68%, reflecting waning interest. Additionally, the number of zero-balance addresses has surged by 10.85%, hinting at liquidations or inactive wallets—a trend common in bearish phases.

Also Read: THORChain Price Prediction 2025, 2026 – 2030: Will RUNE Price Hit $10?

Price Outlook for 2025

OP’s long-term outlook remains uncertain. If bullish catalysts emerge, the price could rally to $3.82 by late 2025. However, if bearish momentum persists, OP may end the year near $1.50, with an average price of around $2.61. The coming weeks will be crucial in determining the asset’s trajectory.

Customer support service by UserEcho