Can Stellar break out? – Mapping XLM’s road to $0.51

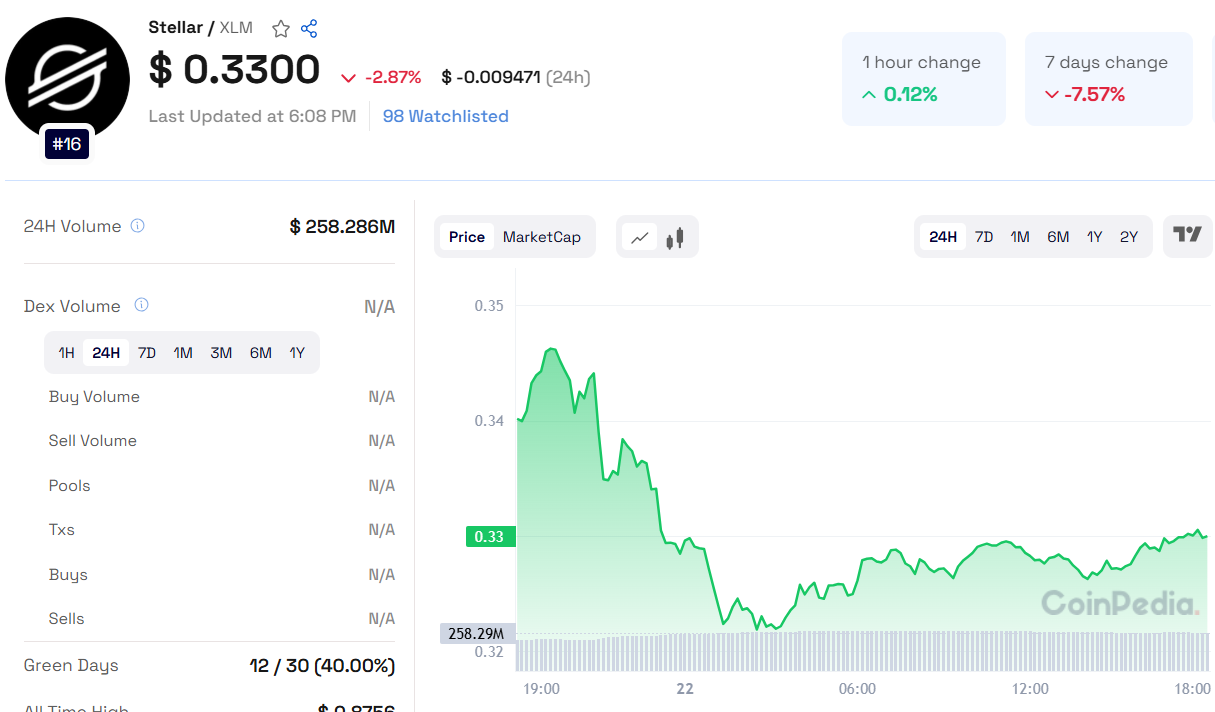

Stellar (XLM) has experienced a mixed week, fluctuating between $0.320 and $0.360. While recent recovery attempts have been accompanied by modest trading volume, technical signals suggest a potential reversal of the short-term trend. However, the journey to $0.40 remains uncertain, with $0.360 serving as the key resistance level.

Read XLM price prediction for more insights

Technical Indicators: A Mixed Outlook

Moving Averages: The recent crossover of the 50-day and 200-day moving averages (MAs) signals possible trend shifts. A bearish crossover occurred recently, but if XLM reclaims the 50-day MA at approximately $0.354, it could mark the start of an uptrend.

RSI (Relative Strength Index): Currently, the RSI stands at 51.12, indicating neutral momentum. If RSI climbs above 60, it would suggest stronger bullish momentum, reinforcing a potential rally.

Market Sentiment and On-Chain Data

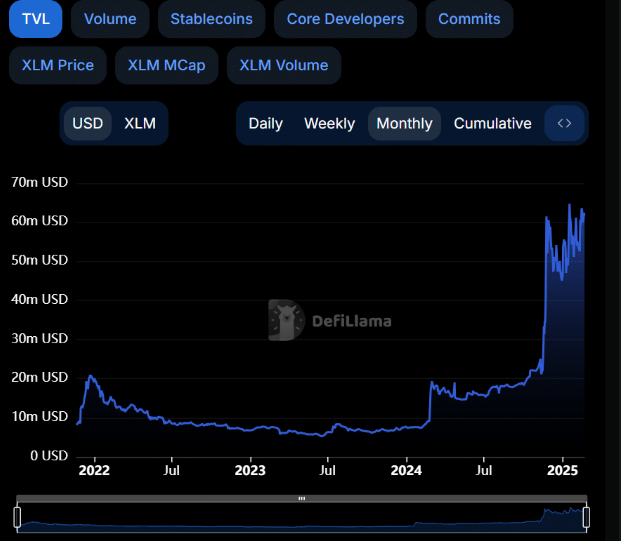

Short-term sentiment for XLM remains bearish due to high price volatility, preventing a confirmed uptrend. However, on-chain data reveals positive signs, with steady growth in network accounts and increasing Total Value Locked (TVL) since late 2024, according to DeFiLlama.

Additionally, the 200-day EMA sits at $0.2428, well below the current price. This indicates XLM’s long-term strength based on TradingView analysis.

Also Read: TAO Price Prediction 2025, 2026 – 2030

Investor Activity: Bullish Accumulation?

The 24-hour Long-Short Ratio stood at 2.31 and has since risen to 2.41 in the 4-hour timeframe, suggesting increased investor buying at press time.

Conclusion: Can Stellar Break $0.40?

The broader crypto market, influenced by Bitcoin and macroeconomic trends, will play a crucial role in Stellar’s trajectory. If XLM breaks above $0.360 with strong volume and RSI momentum, a rally toward $0.40 could be on the horizon. However, traders should closely monitor key technical levels and market sentiment before making decisions.

Customer support service by UserEcho