Bitcoin Price Consolidates Between $94K and $100K: What's Driving the Stagnation?

Bitcoin (BTC) has been trading within a narrow range between $94,000 and $100,000 since early February. Despite recent price stability, there are signs of weakening market dynamics, with reports highlighting declining capital inflows and a drop in derivatives activity. Here's a closer look at the factors behind Bitcoin's sideways movement.

Declining Capital Inflows and Weakening Market Activity

Glassnode’s latest report shows weakening capital inflows into Bitcoin, coupled with declining activity in derivatives markets. The data suggests that short-term holders are accumulating, which typically signals less confidence in the market’s direction. As a result, Bitcoin Price has been stuck in a consolidation phase without clear upward or downward momentum.

High-Rate Environment Adds Pressure on Bitcoin

Ruslan Lienkha, Chief of Markets at YouHodler, explained in an interview that the ongoing high-interest rate environment adds extra selling pressure on markets, including Bitcoin. This has led to a sideways trading pattern, with no clear trend emerging. As long as interest rates remain elevated, it’s expected that Bitcoin will continue to face this pressure and trade within a defined range.

Bitcoin’s Consolidation and Market Weakness

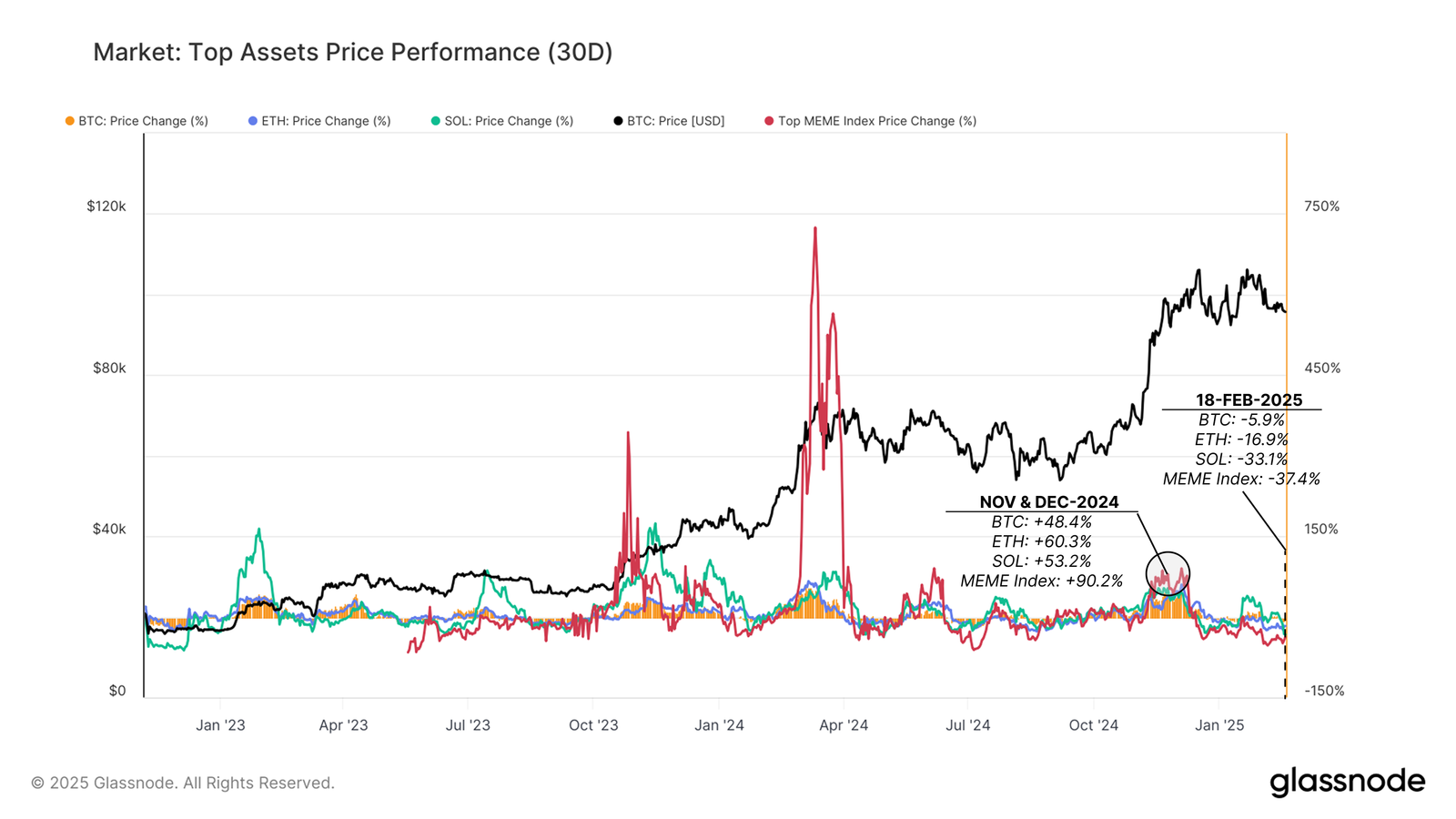

While Bitcoin has remained relatively stable, trading just above $97,000, the broader digital asset landscape shows signs of struggle. According to Glassnode’s "Falling Tides" report, other major assets like Ethereum, Solana, and memecoins have experienced significant drawdowns from their recent highs. This cooling of demand for riskier assets has contributed to overall market weakness.

Riskier Assets Underperforming

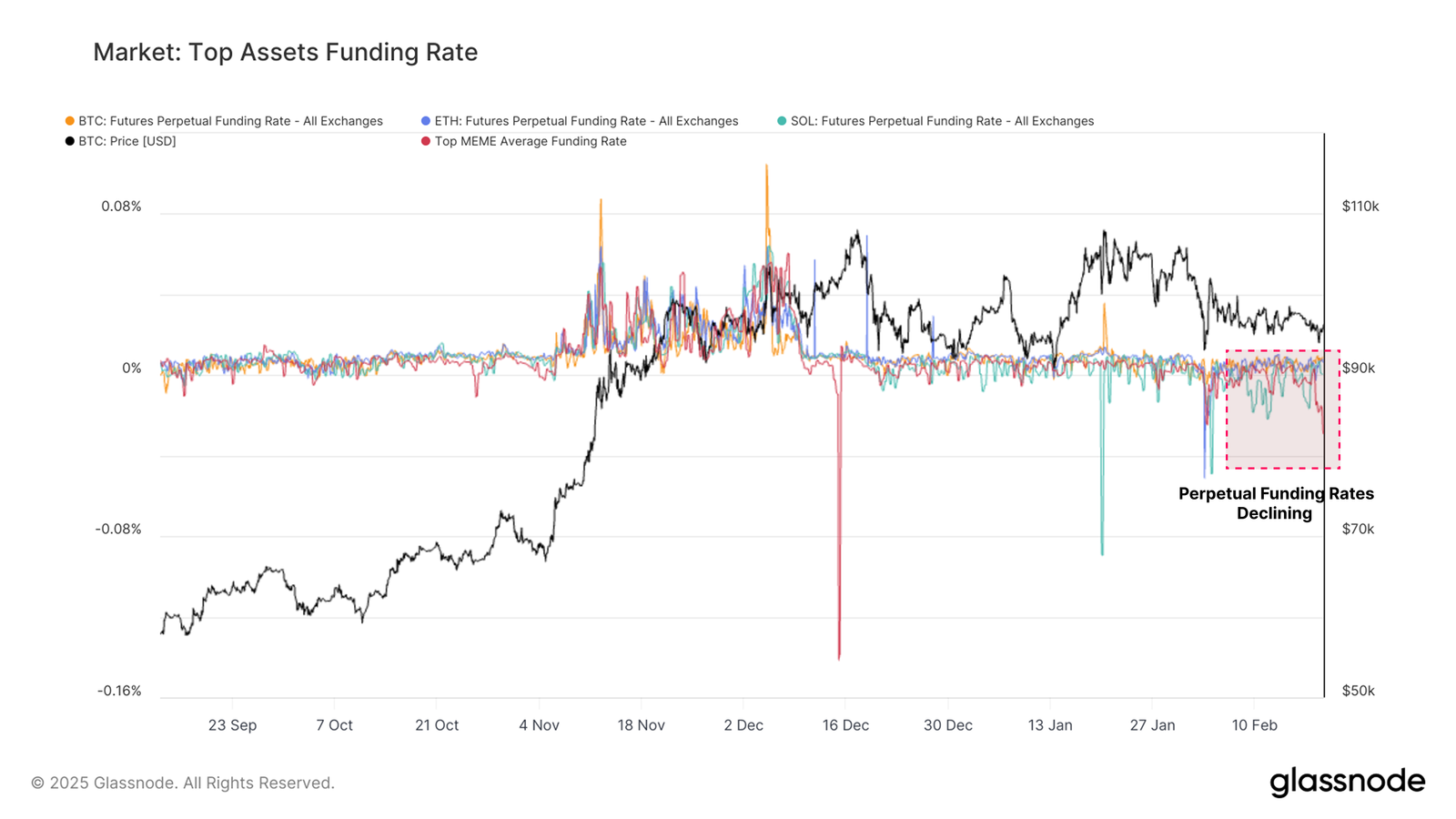

The report also points to capital outflows and declining prices for memecoins, indicating bearish sentiment in the market. Additionally, falling perpetual futures funding rates suggest that traders are unwinding leveraged positions, particularly in riskier assets, further reinforcing the bearish outlook.

Key Levels to Watch for Bitcoin

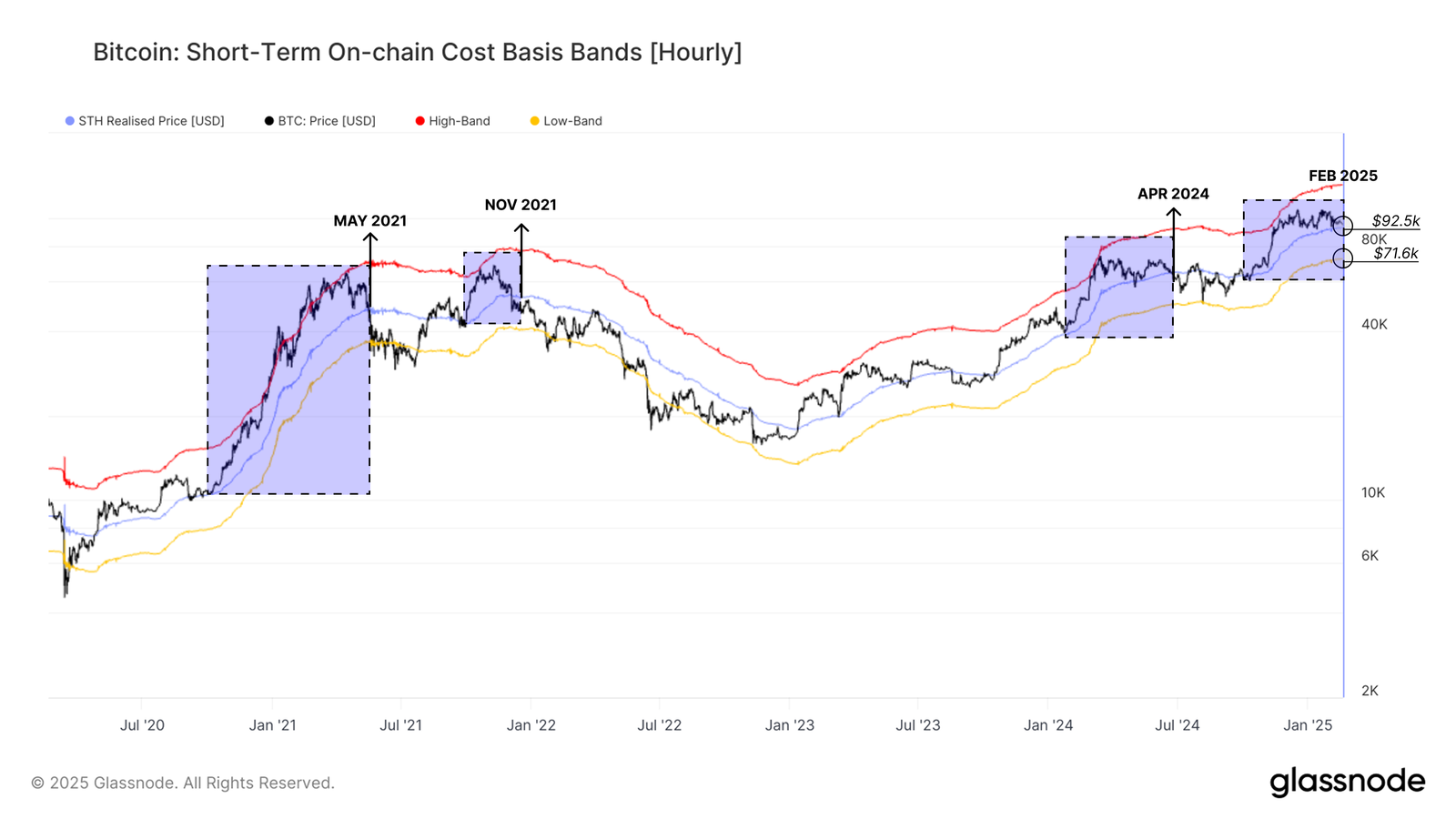

One important level for Bitcoin to watch is the Short-Term Holder cost basis around $92,500. If the price falls below this level, many recent buyers may experience unrealized losses, potentially triggering further downside and panic selling.

According to Glassnode analysts, the current consolidation phase appears to be nearing its end, suggesting that Bitcoin could soon break out in one direction—either up or down.

Bitcoin’s price consolidation between $94,000 and $100,000 is driven by weakening market activity and an ongoing high-rate environment that adds pressure on the crypto market. With key levels like the Short-Term Holder cost basis at $92,500 in play, Bitcoin’s next move could be crucial as the market nears the end of its consolidation phase.

Customer support service by UserEcho