Ethereum (ETH) price still possible, Will It Finally Break Higher?

Ethereum (ETH) remains steady above $2,500, recently climbing past $2,620, signaling short-term bullish momentum. ETH broke a key contracting triangle at $2,700, reaching $2,720 before testing the 50% Fibonacci retracement level of the recent drop from $2,845 to $2,605.

Currently trading above $2,680 and the 100-hourly simple moving average, ETH faces resistance at $2,725. A break above $2,755 (61.8% Fib level) could propel it toward $2,820. If momentum sustains, Ethereum price may rally to $2,880 and even $3,000.

Potential Downside Risks

Failure to surpass $2,755 could lead to another dip, with support at $2,700 and $2,660. A drop below $2,620 might push ETH toward $2,550 or even $2,500. Historical trends suggest Ethereum tends to rally in the latter half of Q1, averaging 40% gains since 2020. A similar 20%-22% rise in 2025 could position ETH around $3,500.

Also Read: Filecoin Price Prediction 2025, 2026 – 2030

Market Sentiment and Ethereum’s Future

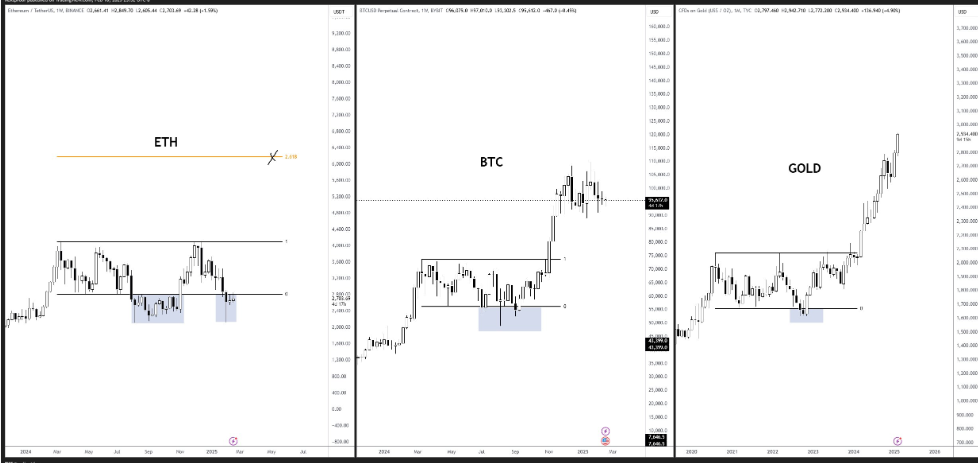

Despite bullish signals, trader Honey notes that the current market dynamics differ from previous cycles due to a surge in altcoins. Meanwhile, Rektproof sees an ETH long position as highly lucrative, comparing its accumulation phase to Bitcoin and gold’s past breakouts.

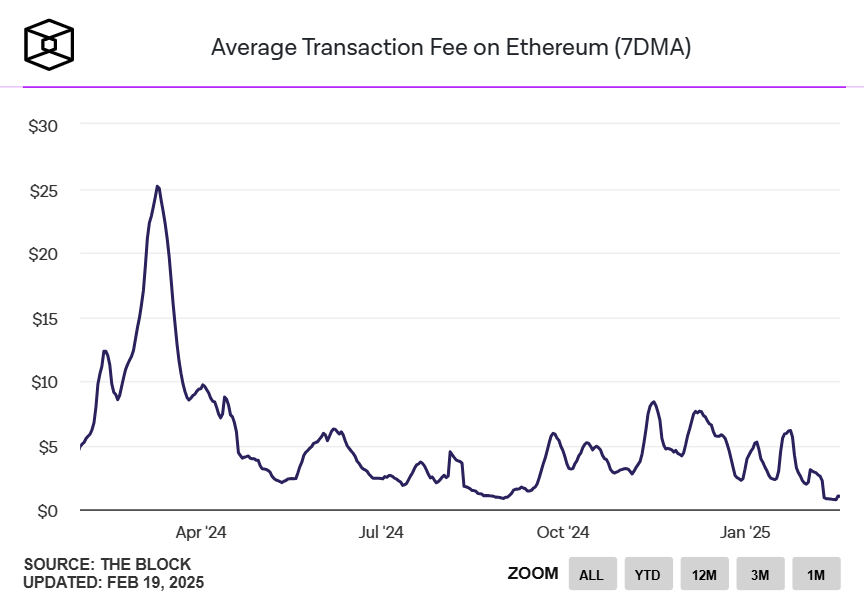

Ethereum's transaction fees have plummeted to four-year lows, indicating weak on-chain demand. Gas prices averaged just 1.61 Gwei last week, dropping to 1.19 Gwei—the lowest since 2020. Additionally, Ethereum’s on-chain volume plunged 46% to $4.19 billion, its lowest since November 2024.

While lower fees often encourage usage, the prolonged decline suggests broader disinterest. If ETH fails to gain traction by Q1’s end, traders may need to reassess their bullish outlook. Still, a breakout above $2,820 could shift the narrative, potentially setting the stage for an all-time high.

Customer support service by UserEcho